Weekly turnover in Nepse below Rs 2bn for second consecutive week

Despite slight improvement, the weekly traded amount in the country's only secondary market remained below Rs two billion for the second consecutive week in the period between January 15 and 19, while the Nepal Stock Exchange (Nepse) index fell by 17.3 points or 1.17 per cent in the review period.

Initial public offerings (IPOs), follow-on public offers (FPOs) and issuance of rights shares of the listed companies have been attributed to the fall in daily turnover in recent weeks. Moreover, the impressive deposit rates being offered by banks and financial institutions at present have also attracted share investors at a time when the market movement has been mostly lateral or on the downside.

Altogether, 11.32 million shares of 153 companies worth Rs 1.86 billion were traded through 14,785 transactions during the week. The traded amount was 6.96 per cent higher than the preceding week when 13,140 transactions of 10.03 million shares of 148 firms that amounted to Rs 1.74 billion had been undertaken.

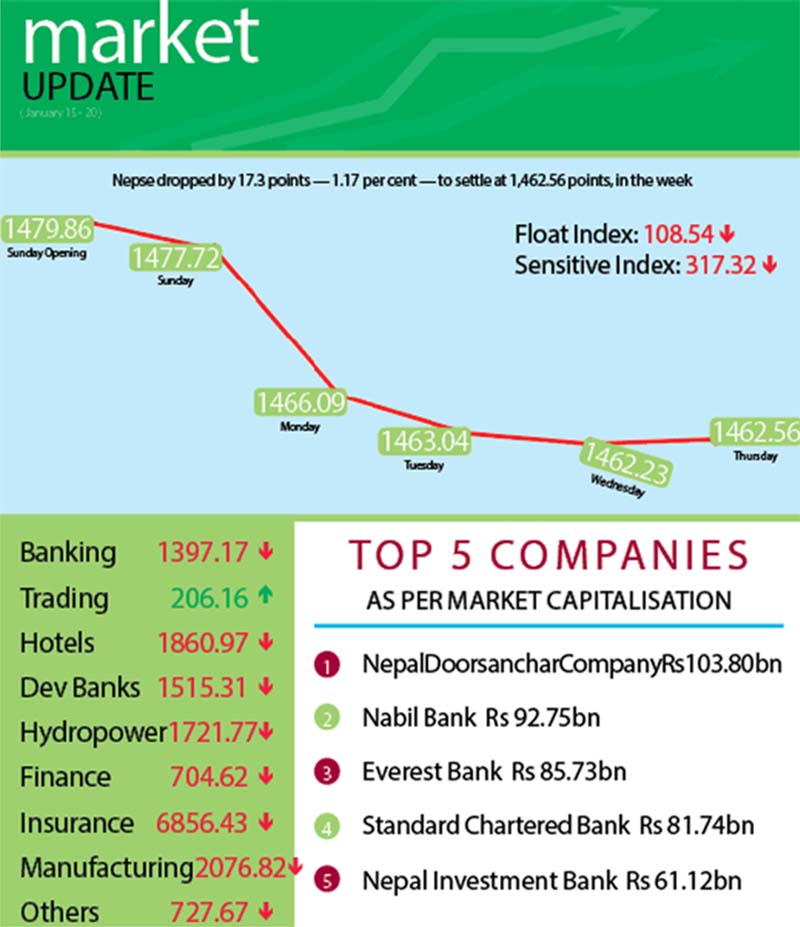

Starting the week at 1,479.86 points on Sunday, the benchmark index had shed 2.14 points by the day's closing. The local bourse was southbound for next three days — dropping 11.63 points on Monday, 3.05 points on Tuesday and 0.81 point on Wednesday. On Thursday, however, Nepse index edged up 0.33 point to close the week at 1,462.56 points.

The sensitive index fell by 2.64 points or 0.82 per cent to 317.32 points. Similarly, the float index also dipped by 1.55 points or 1.41 per cent to 108.54 points.

Apart from trading, which edged up 1.13 points or 0.55 per cent to 206.16 points, all the subgroups landed in the red during the week. Trading sub-index was buoyed by Salt Trading Corporation's share value going up by 3.46 per cent to Rs 239.

The drop of 21.03 points or 1.48 per cent to 1,397.17 points witnessed by banking — the share market heavyweight — was the deadweight for the benchmark index. Even as stock price of Standard Chartered surged by 9.11 per cent to Rs 2,180, the subgroup declined because of banks like Nabil dropping by 3.85 per cent to Rs 1,500 and Everest down 1.61 per cent to Rs 1,894.

Close on its heels, hydropower descended by 25.45 points or 1.46 per cent to end the week at 1,721.77 points. This was due to Arun Valley falling by 3.16 per cent to Rs 245 and Barun slumping by 5.96 per cent to Rs 268.

Manufacturing saw the previous week's gain of 0.2 per cent wiped out as the sub-index dropped by 25.96 points or 1.23 per cent to rest at 2,076.82 points, primarily because of share price of Himalayan Distillery plunging by 15.07 per cent to Rs 637.

After past week's dive of 3.96 per cent, insurance subgroup limited its loss to 78.37 points or 1.13 per cent to close at 6,856.43 points. This was due to firms like Sagarmatha losing 3.69 per cent to Rs 1,173 and Premier down 2.92 per cent to Rs 1,398.

Finance fell by 5.96 points or 0.84 per cent to 704.62 points, others slipped 4.91 points or 0.67 per cent to 727.67 points, development banks shed 3.62 points or 0.24 per cent to 1,515.31 points and hotels dipped 3.97 points or 0.21 per cent to 1,860.97 points.

Meanwhile, Prabhu Bank (Promoter Share) topped the chart in terms of weekly turnover with Rs 209.30 million, followed by Standard Chartered Bank with Rs 140.98 million, Prabhu Bank with Rs 133.47 million, Siddhartha Bank with Rs 84.50 million and Nepal Life Insurance Co with Rs 66.77 million.

Nabil Balanced Fund – I retained its position as the forerunner with regards to trading volume with 3.26 million of its scrips changing hands and Prabhu Bank took the lead in number of transactions, with a total of 1,500 transactions to its name.