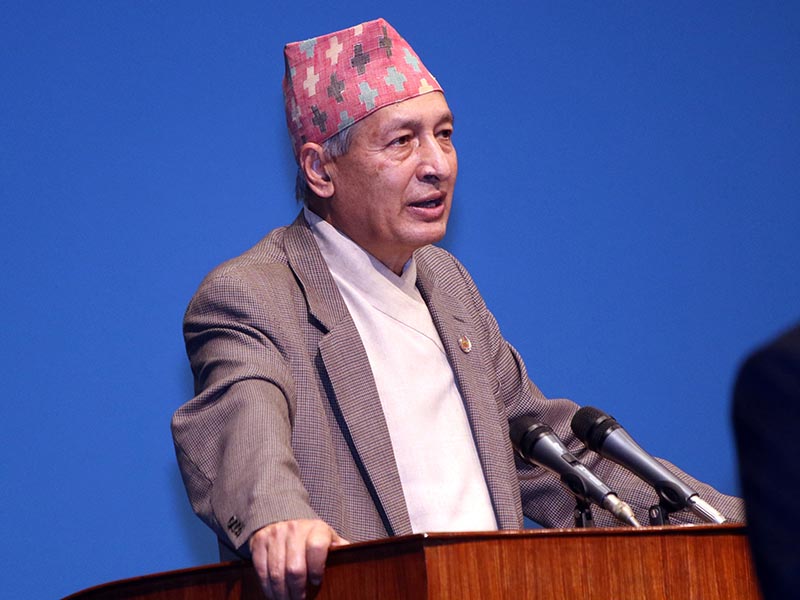

Finance Minister presents budget of Rs 1,474.64 billion for FY 2020-21

KATHMANDU: Finance Minister Yubaraj Khatiwada presented a budget of Rs 1,474.64 billion for the Fiscal Year 2020/2021 in the joint session of the House of Representatives and National Assembly here today, with a major focus on reviving the economy following the effects of COVID-19 pandemic.

The government has prioritised the health sector in the wake of coronavirus crisis and raised the budget for health ministry to Rs 90.69 billion for the fiscal year.

Out of the total budget, government aims to utilise Rs 948.94 billion as recurrent expenditure. Likewise, Rs 352.91 billion and Rs 172.79 billion have been earmarked for capital expenditure and financing provision, respectively.

Moreover, the government has set a revenue collection target of Rs 889.62 billion. Likewise, the government will seek foreign grants and loans of Rs 60.52 billion and Rs 299.5 billion, respectively. Domestic loans amounting Rs 225 billion is expected to balance the expenditures and sources of the budget.

As compared to the previous fiscal year, the budget size has been reduced by 3.8 percent while the economic growth in the upcoming fiscal has been projected at 7 percent.

Highlights of the Budget:

- Rs 90.69 billion has been allocated for the Ministry of Health and Population.

- A budget of Rs 6 billion for coronavirus pandemic prevention and control measures. The said budget has been allocated for drugs, medical equipment and other treatment materials required for Covid-19 response.

- Free life insurance up to Rs 500,000 for all health workers serving against coronavirus and other contagious diseases has been included in the budget this year.

- A 300-bed infectious disease hospital in the Kathmandu Valley will be set up in the fiscal year. A 250-bed intensive treatment unit in public hospitals will be established.

- Capacity enhancement of the National Public Health Laboratory in Teku, Kathmandu

Facilitating heart surgeries for children at Shahid Gangalal National Heart Centre.

- Free treatment of senior citizens with Alzheimer’s, rehabilitation for persons with physical and intellectual disabilities.

- Those unemployed owing to the coronavirus crisis will be mobilised in development works.

- Rs 11.6 billion has been allocated to create additional 200,000 jobs under the Prime Minister Employment Programme.

- Rs 1 billion has been allocated to facilitate employment for 50,000 people through skill-based training. Rs 4.34 billion has been allocated to provide skill-based training to 75,000 people in the coming year.

- Employment will be created for 40,000 people through small farmers credit.

- Foreign nationals will not be employed without permission from the government.

- Rs 1,435 billion in Foreign Direct Investment has been pledged through the IBN.

- Rs 145.22 billion will be allocated in provincial and local level through Fiscal Equalization Grants. Equalisation grant of Rs 55.19 billion and Rs 90.05 billion for provinces and local levels respectively, as against Rs 55.30 billion and Rs 89.95 billion for this fiscal year.

- Conditional grant of Rs 36.35 billion and Rs 161.8 billion for provinces and local levels respectively, as against Rs 44.55 billion and Rs 123.87 billion in the current fiscal year.

- Rs 100 billion refinancing facility for SMEs, tourism and agriculture sectors. It will provide loans at 5 percent interest.

- Rs 50 billion fund to provide wages to employees working in sectors affected by COVID-19. Loans will be made available at 5 percent interest.

- Rs 67.5 billion has been allocated for social security allowance.

- Each branch of banks required to provide subsidised loan facility to consumers. Commercial bank branches have to provide subsidised loan to at least 10 service seekers while development bank branches to at least five service seekers.

- Target to become self-sustained in meat and milk products.

- One local level, one agricultural product to be promoted through Prime Minister Agriculture Programme.

- Rs 11 billion to be allocated for chemical fertilizers to ensure availability before season.

- Food bank concept to ensure uninterrupted supply. Rs 1 billion allocated to establish 200 food banks at local levels

- Farmers credit card concept to be promoted to ensure availability of credit to farmers.

- Rs 2.32 billion has been allocated to expand irrigation. Rs 1.31 billion for lift irrigation.

- 41.4 billion allocation for agricultural sector.

- Concessions to be offered in land registered in the name of females.

- Deposits of those who park funds in cooperatives to be insured.

- Rs 1.55 billion for Chure Conservation Programme.

- Rs 1.26 billion has been allocated for tourism promotion.

- Concession in the parking fees, take-off and landing charges for airline companies.

- Airlines, travel, restaurant services will be facilitated with tax exemption and one province one destination.

- Feasibility study of Tourism University to begin.

- Local tourism to be promoted to revive the tourism sector. Government and private sector employees to be encouraged to visit domestic tourist destinations to promote domestic tourism.

- Industries based on domestic raw materials and export oriented industries to be facilitated in tax.

- All necessary outfit of security personnel to be produced in the country.

- Standard and Metrology Department to be established in all provinces.

- Import of inferior standard products to be halted.

- Home delivery services to be promoted.

- Review trade treaty with neighboring countries.

- Mergers and Acquisitions among Banks and Financial Institutions to be encouraged.

- Concessional loans to be offered at an interest of 5 percent.

- Interest rate in the banking sector to be made realistic.

- 50 percent subsidy on premium of insurance of concessional loans. Rs 13.96 b allocated to cover insurance premium of concessional loans.

- National Payment Gateway to be launched in the coming fiscal year.

- Literacy rate to be 100 percent in the fiscal year; programmes to be operated in 24 districts where literacy rate is below cent percent.

- Virtual classes, online education to be promoted; teaching through radio, television to be promoted.

- Rs 2.7 billion has been allocated for scholarships.

- Rs 7.52 billion allocated to provide free lunch to school children (to benefit 2.8 million students).

- Rs 2.23 billion to mobilise 6,000 volunteers who can teach maths, science.

- Melamchi Water Supply project from the beginning of next FY.

- Rs 5.46 billion has been allocated for second phase of Melamchi Project.

- Rs 43.1 billion has been allocated for water and sanitation.

- 1300 MW electricity to be added to the national grid.

- Rs 4.13 billion for alternative energy.

- Rs 4 billion for rural electrification.

- Rs 37.8 billion for ministry of urban development

- Rs 12.21 billion for the upgradation of East-West Highway

- Rs 8.93 billion for Kathmandu-Nijgadh fast track project

- Rs 6.42 billion for tunnel projects

- Rs 16.3 billion for road maintenance

- Rs 8.66 billion for railways

- Rs 138.8 billion as total budget for physical infrastructure

- Rs 19.42 billion for international airports construction, completion

- Post earthquake reconstruction works to be completed within the coming fiscal year for which Rs 55 billion has been allocated

- 4G network to be expanded nationwide. FTTH internet service to be extended across the country within next two years

- PSA advertisement for online media as well. Cyber forensic lab to be set up.

- Non-Resident Nepali Association's support to be sought for rescue/repatriation of vulnerable/stranded Nepalis

- Free COVID-19 insurance for civil servants worth 100,000 for next one year

- Austerity measures to be adopted in public expenses for next year amid revenue. Austerity directive to be issued.

- Many allowances for civil servants scrapped. Unnecessary public entities to be scrapped.

- Umbrella policy to regulate Public Enterprises. Loss-making PEs to be scrapped or merged.

Headings

Amount (in billions)

General Public Service

494.34

Defence

49.22

Public Peace & Security

56.29

Economic Affairs

389.00

Environment Protection

11.66

Housing & Community Service

81.86

Health

115.06

Entertainment, Culture & Religion

7.23

Education

172.19

Social Security

97.79

Total Budget

1,474.64