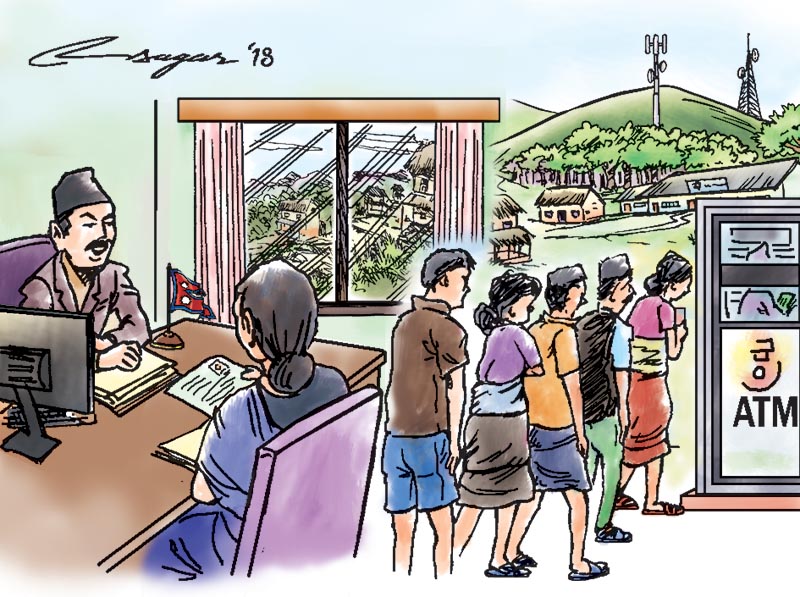

Banking the unbanked: Ensuring financial inclusion

Bringing all people close to banks translates to increased credit and savings opportunities for those who were previously unbanked or did not have access to formal financial services, thereby helping in poverty reduction

Finance Minister Yubaraj Khatiwada unveiled the first federal budget for fiscal year 2018-19 on Tuesday. Among others, the budget aims to digitize government payments and revenue collection and launch an overambitious campaign of opening bank accounts for every Nepali citizen within a year. The overall objective of this policy is to expand financial inclusion, defined as people having access to financial services, ranging from savings, payments and transfers to credit and insurance, through formal financial institutions.

In particular, by moving away from cash and digitizing government payments and revenue collection, government can not only cut costs and increase efficiency but also can reduce the number of unbanked adults, and thereby increase the level of financial inclusion, a key component of social inclusion.

Financial inclusion is often confused with financial depth. Unlike financial inclusion which is measured using number of bank branches per inhabitant (supply side) or share of adults (age 15+) in the economy using financial services from formal financial institutions (demand side), financial depth is measured using macro-indicators such as domestic credit to the private sector as a percentage of GDP.

Moreover, financial depth does not provide information about financial inclusion.

An economy can score well on financial depth but still can have a low level of financial inclusion if bank credit is concentrated among a small number of relatively large firms and wealthy individuals.

For example, domestic credit to the private sector accounts for 81 per cent of GDP in Nepal, but only 45 per cent of adults in the country reported having an account with formal financial institutions. On the other hand, in India, a country with domestic credit to the private sector of 49.8 per cent of GDP, 80 per cent of adults reported having an account with formal financial institutions.

Given this, financial deepening and financial inclusion cannot be considered as substitutable policy goals. In fact, policymakers and academics have increasingly focused on financial inclusion as a stand-alone policy objective because of its strong relationship to development. For instance, a recent study shows that although United Nations Sustainable Development Goals (SDGs) do not explicitly focus on financial inclusion, financial inclusion can act as a key enabler for 7 of the 17 SDGs.

This includes eliminating poverty and achieving food security, among others. In particular, financial inclusion can help eliminate poverty (SDG 1) by minimising the unexpected expenditure shock through the use of savings or remittances received via formal financial institutions. It can also help achieve food security (SDG 2) by allowing farmers to make greater investments through increased access to agricultural credit during planting season, leading to higher agricultural yields.

If we define financial inclusion in terms of people having deposit accounts at banks and other formal financial institutions, financial inclusion still remains significantly low in Nepal.

According to the 2017 World Bank Global Financial Index, launched last month, financial inclusion in Nepal increased from 25 per cent in 2011 to 45 per cent in 2017 – a whopping growth of 80 per cent. This growth, although looks impressive, is still lower than the growth of 127 per cent and 111 per cent recorded for India and the South Asian region respectively. In addition, the same database shows that Nepal also had a lower level of financial inclusion vis-a-vis South Asia region and three South Asian countries — Sri Lanka, Bangladesh and India — for all available data years (2011, 2014 and 2017).

Among others, the World Bank database shows that distance to financial institutions is one of the reasons why people remain unbanked.

The distance barrier reflects the unwillingness of banks and other financial institutions to open their branches in rural areas. As of March 28, 2018, only 394 out of 753 local levels, designed under the new federal structure, had bank branches. To reduce the distance barrier and facilitate the government transactions, Nepal Rastra Bank issued a directive asking commercial banks to establish their branches in the remaining 243 local levels by mid-May and 116 local levels by mid-July this year. Following this directive, banks have opened their branches to 507 local levels by mid-May, indicating that NRB was not able to meet the target of 637 local levels as per the directive. While banks unwilling to open branches in local levels by mid-May would face a penalty as per NRB Act 2002, no such penalties were imposed for banks failing to do so within the specified deadline.

Expanding bank branches into unbanked local levels not only reduces the distance barrier and facilitates the government transactions but also has an implication for poverty alleviation. For example, a study by Robin Burgess, Grace Wong, and Rohini Pande in 2005 shows that state-led rural branch expansion in India from 1977 to 1990 led to a significant reduction in poverty across Indian states. The underlying rationale is that bank branches expansion translates to increased credit and savings opportunities for those who were previously unbanked or did not have access to formal financial services. Whether a similar impact on poverty reduction would be achieved through NRB bank branch expansion remains an open research question.

Shrestha is student of economics at New York University and Joshi and Dongol are economists