Blockchain in real estate: A radical revolution

With the evolution of the blockchain, we are now on the edge of a radical revolution. Even in the absence of a bank or other financial institutions, we can share value through technology alone

First things first. Blockchain itself is not illegal in Nepal or any other country, but with regard to cryptocurrency, it’s considered illegal. If you ask ten people about blockchain, nine may define it in terms of cryptocurrency. But actually, blockchain is a decentralised network consisting of blocks, which are groups of records containing information in an encrypted and secure manner.

Blockchain is a technology. Bitcoin is a currency, a cryptocurrency which runs on blockchain technology. From the legal point of view and from many other perspectives, these two are completely different. Technology itself is never illegal, the use of it is. For example, if a person uses Facebook to blackmail someone, his act is considered illegal not Facebook.

In the same way, the use of blockchain in other sectors like data sharing management, real estate marketing, regulating supply chain in business and any other legitimate affair is not considered illegal.

What I am trying to imply here is using blockchain in the Nepali real estate. The real estate and housing market have started to pick up in Nepal after the recession period. Since the market price is expected to increase with new investments, the country stands on the edge of an investment boom. However, Nepal is still doomed by something that discourages investment and makes it less convenient for both domestic as well as foreign stakeholders.

Since the start of the property business, some notable scams have put the credibility of the Nepali real estate market at stake. So will it be rational for the government to consider using blockchain technology to improve the real estate market? Or should we keep relying on old vulnerable institutions and endure more problems?

Let’s take a hypothetical sample to see how the blockchain works in the real estate business. A resident from Pokhara planning to buy some land in Kathmandu sees an advertisement for a piece of property. Immediately he opens the blockchain ledger on his computer and verifies if the property is registered in the government record.

He also finds the entire details about the land, including authentic owner, tax information, land title documents, government approval and other required information. He then contacts the owner, negotiates the price and gets ready to buy the land.

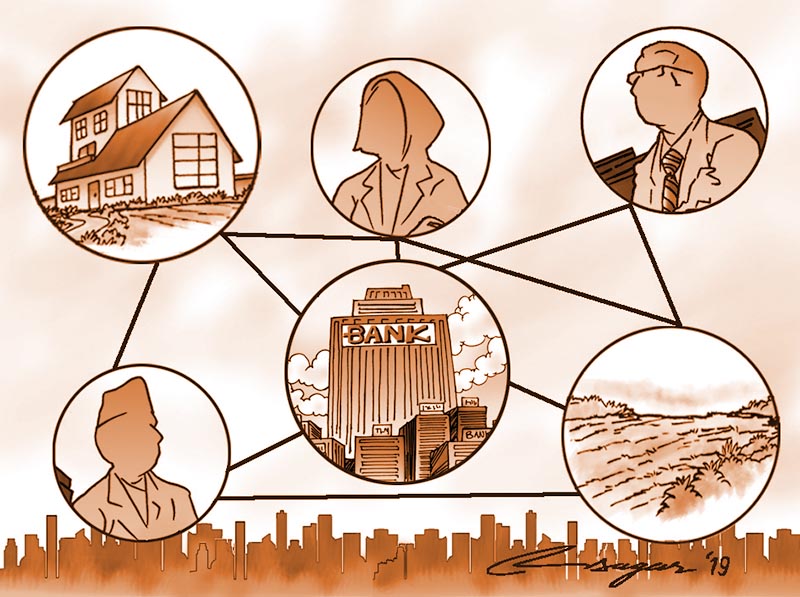

Now he adds his bank to the blockchain network, the bank approves the loan after going through the property document and title history. The documents about the sale get signed digitally, and the payment is released to the seller’s bank account. So every detail is recorded transparently in the distributed ledger, without any risk of fraud. This hypothetical scenario can be the future of the Nepali real estate if the government were to encourage blockchain technology in the land business. However, the real scenario while buying a small piece of land begins with the brokers, sellers, loan providers, lawyers, bureaucrats land registry office, all at constant risk of being cheated. It’s actually a long, hard and insecure deal.

American economist Douglass North in his 1991 paper defines institutions as “humanly devised constraints that structure political, economic and social interactions”. Throughout history, institutions have been devised by human beings to create and order and reduce uncertainty in exchange. Going with his idea, institutions like a bank are a tool to minimise uncertainty, so we can exchange value in a systematic and secure way.

With the evolution of the blockchain, we are now on the edge of a radical revolution. Even in the absence of a bank or other financial institutions, we can share value through technology alone. Blockchain is a public ledger that indicates who owns what and who performs what transaction to whom.

Similarly, this technology could also help traders by cutting off extra inspection costs, registration and loan fees as well as property taxes; all will be done by smart contracts. Today the Nepali real estate procedure is highly dependent on the slow inefficient bureaucracy and paperwork.

Adopting the blockchain in the real estate business can shepherd the investment dream of the prime minister by creating a flexible model to connect potential land investors with likeminded sellers on a very secure platform. It will also end the doomed fate of the low-functioning institutions and corrupt bureaucrats by replacing the system with smart contacts (a computerised transaction protocol that executes the terms of a contract). Additionally the government will also benefit from increased tax revenue because of the easy property tracking mechanism in the blockchain.

Under the blockchain system, property of any kind can be liquefied and exchanged like stocks, as any trader can sell part of the share of a particular property and need no single buyer. Amid such a system, people with weak financial potential can also enter the investment business.

Blockchain is on verge of revolutionising the future of real estate transactions in the same way the Internet did in information sharing. This technology offers an opportunity to revisit our crippled system, ranging from improving the institutional procedure to risk management. Its benefits include transparency, accessibility, security and easy traceability. They will solve major issues and make Nepal a flexible investment hub for both domestic and foreign stakeholders.