Cooperative movement in Nepal: Still going strong

The number of cooperatives must be reduced through acquisition or merger. But to encourage more and more cooperatives to do so, attractive incentives like a reduction in corporate tax need to be introduced

The cooperative movement in Nepal began with the establishment of the first cooperative - Bakhan Multi-purpose Cooperative Institute - in Chitwan way back in 1957. With it, the first Cooperative Act was enacted in 1960. The cooperative movement, however, did not pick up momentum until the 1980s, when a large number of community-based savings and credit cooperatives came up across Nepal. In fact, liberalisation and open market economy in the 1990s also helped the emergence of cooperatives in the country. As the cooperative movement spread to every nook and cranny of the country, the need for forming an apex coordinating body was acutely felt. As such, the Nepal Federation of Savings and Credit Cooperative Unions (NEFSCUN) was formed in 1988.

The first People’s Movement brought about sweeping political changes in the country in the early 1990s. The monolithic Panchayat dispensation gave way to multi-party democracy, and the waves of liberalisation and open market economy swept the country as in the rest of the world. The cooperative movement also got a further boost. So to give a further shot-in-the-arm to the cooperative sector, another Cooperative Act was promulgated in 1992. The Act clearly stated that the government would no longer directly promote cooperatives, indicating they would have to flourish on their own. As desired by the government, cooperatives have since been growing by leaps and bounds. The Constitution of Nepal 2015 has recognised cooperatives as one of the three pillars of the national economy. Another Cooperative Act was promulgated in 2018 to help cooperatives keep abreast of the changing times.

The constitution has envisioned national prosperity through the participation of public, private and cooperative sectors. Cooperatives can, like other financial players, help notch up entrepreneurial development by promoting micro-, medium- and big-scale enterprises in the country, besides creating job opportunities.

The cooperatives’ contribution to the gross domestic product (GDP) is around 4 per cent, whereas their contribution to the financial sector stands at around 20 per cent. There are around 35,000 cooperatives in the country with 6.3 million members, out of which women constitute 50 per cent. Over 60,000 people are directly employed in cooperatives.

In the changed context, cooperatives should adopt new technology and amplify their role in production, distribution and service sectors by diversifying their business. Division cooperative offices have now been dissolved throughout the country and local and provincial governments have been assigned to look after and regulate cooperatives. Local and provincial governments can promulgate and implement the laws relating to cooperatives.

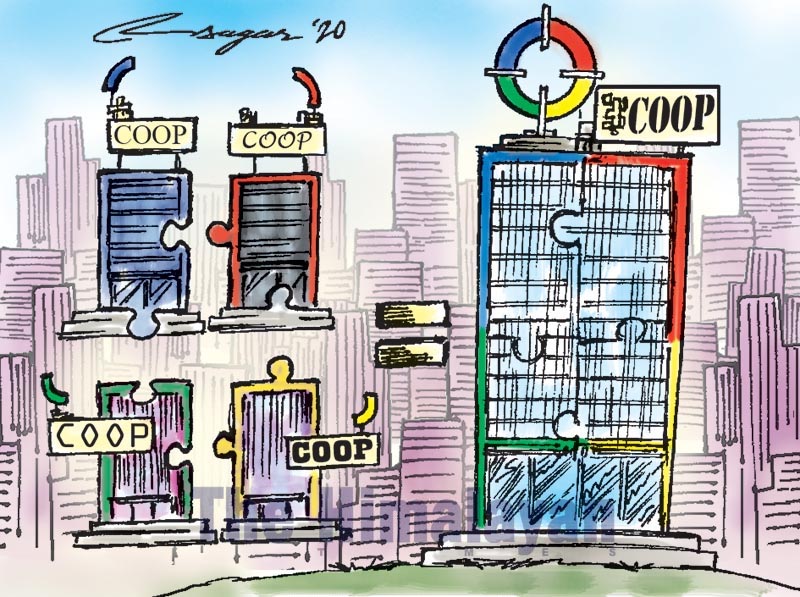

Given the large number of cooperatives, the government is now mulling reducing their number as it is difficult for the government to monitor, supervise and regulate them.

The Kathmandu Metropolitan City (KMC), where there are 1,856 cooperatives at present, has initiated the process of merging cooperatives. The KMC aims at reducing their number to just 700. There are around 200,000 people associated with the cooperatives. These cooperatives have mobilised around Rs 52 billion and disbursed loans to the tune of around Rs 41 billion.

As an incentive, cooperatives that go into a merger will be exempted from a municipal tax for five years. The rate of municipal tax is Rs 5,000 per year. Till now, four cooperatives based in the Kathmandu Metropolis have merged. The KMC is hopeful that more will go for a merger in the future. The KMC has now halted the process of incorporating new cooperatives. However, this restriction is not applied to cooperatives to be promoted by labourers. At one time, the government gave free rein to the establishment of cooperatives. Consequently, cooperatives have mushroomed to such an extent that it has been like an albatross around the neck of the government. Together with the number of cooperatives, the government is also trying to reduce the number of commercial banks, development banks and finance companies.

This is all due to a lack of far-sight on the part of the government. Anyway, it has dawned on the government that in a small economy like ours, the number of financial players is still large. Economic experts also opine that such financial players should be reduced drastically and that quality should be preferred to quantity.

There is no argument against reducing the number of cooperatives through acquisition or merger. But to encourage more and more cooperatives to opt for acquisition or merger, sufficient incentives need to be provided. Small incentives like exemption from payment of municipal tax for five years may not do the trick. Other attractive incentives like a reduction in corporate tax need to be introduced.

In the final analysis, cooperatives are important players in the financial sector. They can play a pivotal role in uplifting the economic conditions of the people, especially those living in the rural areas. While it is important to drastically reduce their number, at the same time they should also be minutely monitored so as to improve their management, beef up their internal control and, more importantly, check irregularities for the growth of the cooperative sector.