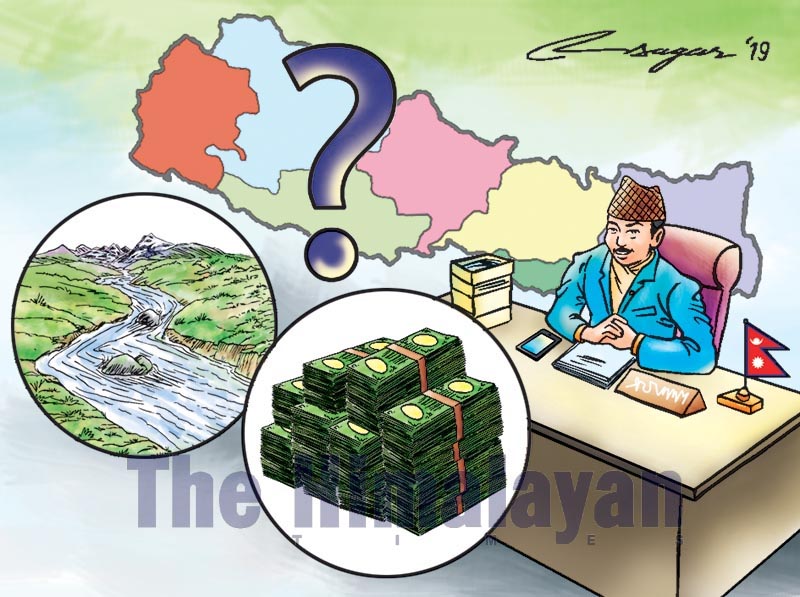

Fiscal Commission: Issues at stake

It rests on the Fiscal Commission to ensure that the country’s fiscal governance is set on the right track to warrant that the multi-level federation, envisaged according to the new constitutional arrangement, delivers effectively

The arrangement related to distribution of fiscal resources is the mainstay of federal polity. In fact, no federal institution can function effectively unless adequate financial resources are provisioned. Principally, it is affirmed that economic stabilisation and income redistribution functions should be performed at the national level. But the functions related to provision of public goods and service delivery should be carried out at the sub-national level. According to Anwar Shah, renowned fiscal federalism expert, when governmental decisions are made closer to the citizenry rather than in the national capital, the public is likely to keep track of the decision about government services and taxes to finance them.

In fact, the way taxes and spending decisions is made and inter-governmental transfers are structured determine the efficiency and effectiveness of the federal governance system. However, in many countries, assignment of tax and expenditure between the national government and sub-national levels is not equitably instituted and established. And sub-national governments have at their disposal diminished volume of resources that do not match their needs and requirements. In several cases, local governments are endowed with enlarged and broad-based set of unfunded functions. As a consequence, they cannot discharge their functions and responsibilities in an effective way.

Article 228 of the constitution mentions about the taxing authority of the local government. It provides that the local governments can generate their income through taxes and loans from fiscal institutions subject to the provision of the law. The provision further empowers the local government to levy tax on the subjects of competencies as prescribed without having an adverse effect on the national fiscal policy, free movement of goods and services, capital and labour market and fiscal policies of the neighbouring provinces.

Article 229 of the constitution provides for a consolidated fund in the Gaunpalika (village government) and Nagarpalika (municipal government). In the consolidated fund, all income receipts like grant transfers from the federal and provincial government, own source of revenue, loans and income from other sources should be deposited. The expenditures from the consolidated fund should be allocated according to the procedure prescribed by the local government law. There are three major sources of revenue of the local government, which are their own tax sources, shared taxes and revenues, and inter-governmental transfers.

A local government budget is a document that makes disclosures of the anticipated income for

the financial year from each income source, plan and non-plan expenditures, and actual income and expenditure for the financial year before the current budget year. Like all government budgets, local government budgets consist of two sides, namely an operating/recurring budget, which covers the running cost, and capital cost, which covers the cost for infrastructure development and purchasing new equipment. Local governments are not generally allowed to plan deficit financing unless they have a definite source of income that compensates for the deficit and shortfalls.

Most importantly, the constitution provides for the creation of a National Fiscal and Natural Resource Commission to devise a methodology and mechanism for distribution of financial resources and natural resources among the three levels of the government. The commission determines the system and structure of intergovernmental fiscal relations.

Article 251 of the constitution enumerates a list of roles and functions of the commission. The major functions, as stipulated in the constitution and the act, include review of the finances of the government in accordance with the functional responsibilities; prepare an elaborate basis and design for sharing the revenue of the divisible pool in the federal consolidated fund; recommend a formula and process for sharing and distribution of equalisation grants to the provinces and local government; create the basis for sharing the tied and conditional grants among the provinces and local governments though proper evaluation on the basis of national policies and programmes.

The commission is also mandated to analyse the overall economic indicators to recommend the upper limit on internal borrowing for the federal, provincial and local government and review the basis of revenue sharing and suggest measures for improvement. The commission works out the modality for the distribution of natural resources and suggests ways and means to resolve disputes arising out of natural resources benefit sharing and distribution between the federal and provinces, among the provinces, provinces and local governments, and among the local governments.

The commission has thus extensive roles and responsibilities. However, the commission is yet to be fully constituted and made competent enough to function effectively. The chief of the commission has been appointed, but other members are yet to be filled in. It rests on the commission to ensure that the country’s fiscal governance is set on the right track to warrant that the multi-level federation, envisaged according to the new constitutional arrangement, delivers effectively.