CGT concerns weigh on investors’ sentiment

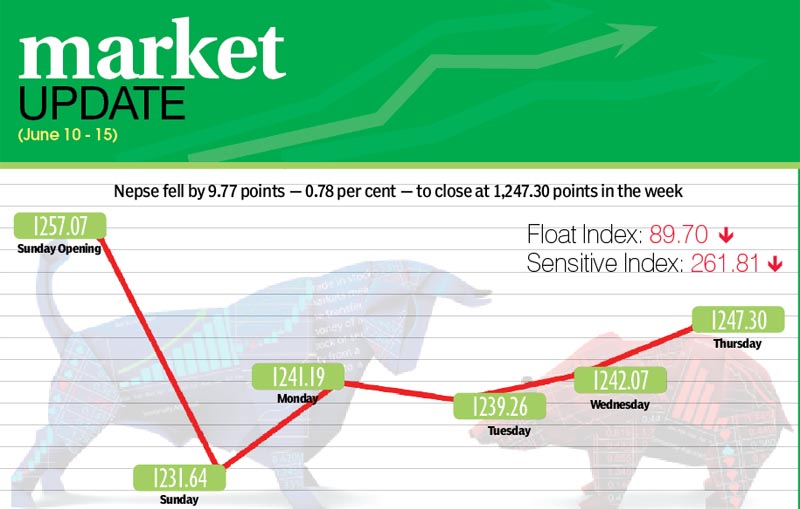

Concerns related to revision in calculation of capital gains tax (CGT) on trading of bonus and rights shares continued to weigh on the only secondary market of the country, with Nepal Stock Exchange (Nepse) dipping by 0.77 per cent or 9.77 points in the trading week

between June 10 and 14.

“Moreover, both brokers and share investors are confused about conducting trade online,” said Prakash Rajhaure, independent stock analyst. Nepse had introduced online share trading software on June 13.

The benchmark index, which had opened at 1,257.07 points on Sunday, had plunged by 25.43 points by the time of closing to 1,231.64 points. It shed 9.55 points on Monday to land at 1,241.19 points and was down 1.93 points on Tuesday to close at 1,239.26 points.

The local bourse rose by 2.81 points to 1,242.07 points on Wednesday and gained 5.23 points to close the week at 1,247.3 points.

According to Rajhaure, if left unaddressed, the CGT issue could drag down the benchmark index lower than the earlier lowest point of 1,168.55 for this fiscal on March 26.

The sensitive index, which measures the performance of class ‘A’ stocks, went down by one per cent or 2.65 points to 261.81 points. The float index that which gauges the performance of shares actually traded also shed 0.85 per cent or 0.77 point to 89.7 points.

In the review period, manufacturing, hotels and hydropower landed in the green zone. The manufacturing subgroup rose by 1.97 per cent or 45.93 points to rest at 2,379.68 points. This was on the back of Unilever Nepal’s share price rising by Rs 1,070 to Rs 27,570.

Similarly, the hotels sub-index jumped by 1.53 per cent or 28.71 points to 1,895.16 points. Share value of Soaltee went up by five rupees to Rs 249.

Hydropower subgroup also rose by 0.85 per cent or 13.17 points to land at 1,551.5 points, with hydropower companies like API gaining Rs 19 to Rs 319.

Insurance, trading, banking, development banks, others, finance and microfinance sub-indices went down in the review period. The insurance subgroup plummeted by 1.54 per cent or 99.66 points to rest at 6,353.02 points. Share price of Everest Insurance fell by Rs 50 to Rs 1,400.

The trading subgroup dropped by 1.29 per cent or 2.62 points to 200.41 points.

Banking slipped by 0.99 per cent or 10.57 points to 1,054.21 points. This was due to commercial banks like Himalayan and Nabil losing Rs 18 to Rs 560 and Rs 17 to Rs 958, respectively.

Similarly, the development banks sub-index shed 0.95 per cent or 14.02 points to land at 1,454.98 points and others subgroup also dipped by 0.69 per cent or 5.04 points to 723.46 points.

Finance subgroup descended by 0.39 per cent or 2.46 points to 624.23 points, and microfinance went down by 0.21 per cent or 3.61 points to rest at 1,666.7 points.

Altogether, 4.8 million shares of 186 companies worth Rs 1.72 billion were traded through 23,368 transactions during the week. The traded amount was 2.14 per cent higher than the total weekly turnover of the previous week, which was recorded at Rs 1.68 billion. In the past week, 4.02 million shares of 179 companies had changed hands through 20,662 transactions.

Mega Bank Nepal took the lead in all three categories — trading volume, number of transactions and weekly turnover — with 465,000 units of its shares changing hands through 1,189 transactions that amounted to Rs 99.57 million.

Nepal Life Insurance with Rs 71.7 million, Nabil Bank with Rs 60.11 million, Nepal Doorsanchar Company with Rs 55.8 million and Civil Bank with Rs 55.53 million rounded up the top five firms in terms of weekly turnover.

NEW LISTINGS

Company

Type

Unit

Best Finance

Rights

1,652,850

Multipurpose Finance

Bonus

164,736

Prime Life Insurance

Rights

9,763,200

Prime Life Insurance

Bonus

1,983,150

Rairang Hydropower

Ordinary

5,600,000

Siddhartha Bank

Rights

6,826,117.19

Source: Nepse