Confusion related to monetary policy weighs on Nepse

Kathmandu, September 5

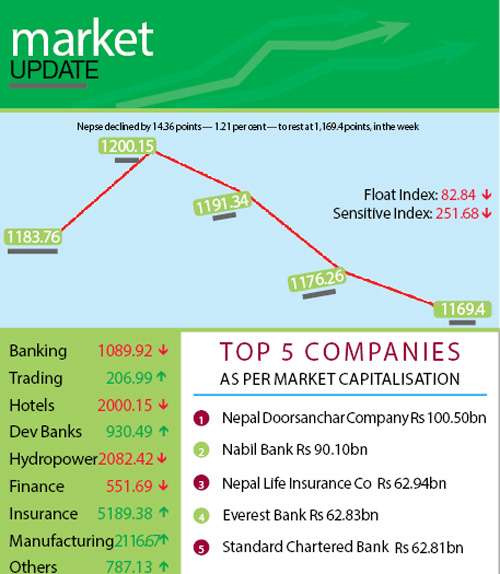

Confusing and contradicting views related to the latest monetary policy of Nepal Rastra Bank (NRB) weighed on the sentiment of stock investors during the last trading week. Consequently, the Nepal Stock Exchange (Nepse) index dropped 14.36 points or 1.21 per cent week-on-week to rest at 1,169.4 points, from August 31 to September 3.

“While experienced investors are taking a wait-and-watch stance, new investors seem keen to book profit as there is some confusion regarding the latest monetary policy that requires banks and financial institutions to raise their paid-up capital significantly within the next two years,” explained Prakash Rajaure, a stock

market analyst.

According to him, the Nepse index may dip slightly in the coming days but it is unlikely the secondary market is turning bearish.

The country’s only secondary market remained closed on Sunday to observe Gaijatra festival and opened on Monday at 1,183.76 points. By the day’s closing, the benchmark index had surged by 16.39 points, nearly recovering all the loss of the previous trading week. However, the market retreated to negative territory over the next three trading days, with the local bourse shedding 8.81, 15.08 and 6.86 points on Tuesday, Wednesday and Thursday, respectively.

Altogether 4.05 million units of shares of 161 companies worth Rs 2.53 billion were traded in the stock exchange through 10,929 transactions. The traded amount was 1.69 per cent more than the preceding week when 16,134 transactions of 6.42 million scrips of 169 listed firms amounting to Rs 2.50 billion had been recorded.

The sensitive index, which gauges the performance of class ‘A’ stocks, declined by 4.06 points to 251.68. Similarly, the float index that measures the performance of shares actually traded also dipped by 1.5 points to 82.84 during the review period.

Hydropower, banking, hotels and finance landed in the red, while the remaining subgroups witnessed gains over the week.Manufacturing led the pack of gainers, surging by 4.74 per cent to 2,116.67 points, on the back of Unilever’s stock value rising by Rs 1,847 to Rs 30,000.

Nepal Telecom’s stock price went up by Rs 19 to Rs 670, which in turn helped the others subgroup ascend 2.92 per cent to 787.13 points.Adding to the previous week’s gain of 4.25 per cent, the sub-index of development banks rose by 1.16 per cent to 930.49 points. Nagbeli’s stock price went up by Rs 42 to Rs 2,163 and Chhimek’s by Rs 15 to Rs 1,595, among others.

As opposed to the previous week when insurance had been the top gainer, the subgroup inched up by a mere 0.18 per cent to 5,189.38 points this time around. Trading also added minimal 0.48 points to rest at 206.99.

Banking, the subgroup with the highest stake in market capitalisation of the stock market, was down 2.87 per cent to 1,089.92 points. The sub-index was weighed down by the likes of Himalayan Bank’s stocks losing Rs 60 to Rs 1,250, and Agricultural Development Bank’s down Rs 35 to Rs 465, among others.

Hydropower also descended by 2.08 per cent to 2,082.42 points as Chilime’s share value plunged by Rs 35 to Rs 1,455 and Sanima Mai’s by Rs 33 to Rs 822.

Even though Taragaon’s shares rose by Rs 18 to Rs 260, the hotels subgroup dropped 0.74 per cent to 2,000.15 points, as Soaltee’s stock price was down eight rupees to Rs 470 and Oriental’s dipped by one rupee to Rs 613.

Finance managed to limit its loss to a minimal 1.52 points, closing at 551.69.Similar to the previous week, Everest Bank retained the top spot in terms of highest turnover with Rs 416.55 million. Nepal Investment Bank (Promoter Share) with Rs 147.41 million, Kumari Bank with Rs 144.16 million, National Life Insurance with Rs 140.92 million and Nabil Bank (Promoter Share) with Rs 110. 69 million rounded up the top five in this category.

Similarly, Siddhartha Investment Growth Scheme-I was the forerunner with regards to number of shares traded with 362,000 of its scrips changing hands. Likewise, Kumari Bank topped the chart in terms of transactions, recording 867 deals.