COVID weighs on share investors’ sentiment

Kathmandu, August 15

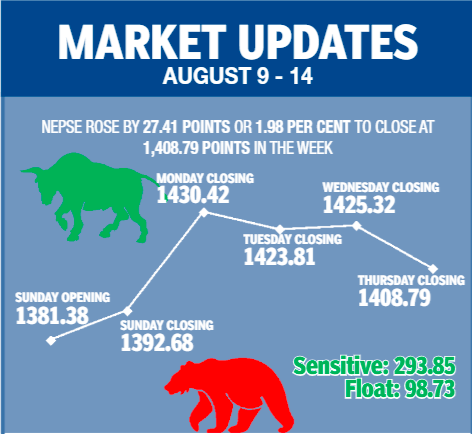

The share market recouped some of the earlier losses, as the Nepal Stock Exchange (Nepse) index went up by 27.41 points or 1.98 per cent week-on-week in the trading period between August 9 and 13.

According to share market analysts, the sole secondary market has not been bullish as it normally is around this time of the year because the coronavirus pandemic has weighed on the investors’ sentiment.

The fact that share investors are holding back was also evident in the average daily turnover in the review week, which fell 12.14 per cent to Rs 1.16 billion from Rs 1.32 billion in the previous week.

However, since the market had remained closed last Tuesday due to Gai Jatra celebrations, as opposed to being open for normal five days in the review week, the weekly turnover went up by 9.83 per cent to Rs 5.81 billion. The weekly traded amount in the previous week had stood at Rs 5.29 billion.

In the trading week, Nepse witnessed 132,681 transactions of 17.47 million shares of 197 companies. For comparison, 85,600 transactions of 15.79 million shares of 194 companies had been undertaken in the preceding week.

The benchmark index had opened at 1,381.38 points on Sunday and gained 11.30 points by the day’s closing. By surging 37.74 points on Monday, Nepse index had breached the 1,400-point threshold. While the local bourse slipped by 6.61 points on Tuesday, it inched up by 1.51 points on Wednesday, but fell 16.53 points on Thursday to close the trading week at 1,408.79 points.

Sensitive index, which measures the performance of class ‘A’ stocks, rose by 1.48 per cent or 4.29 points to 293.85 points, and float index that gauges the performance of shares actually traded went up by 2.08 per cent or 2.01 points to 98.73 points.

While hotels and trading landed in the red during the trading week, their losses were limited to less than one per cent. Hotels fell by 0.90 per cent or 13.69 points to 1,510.25 points and trading shed 0.20 per cent or 1.66 points to rest at 830.39 points.

In the meantime, insurance companies led the pack of gainers.

The subgroup of non-life insurance firms surged by 5.48 per cent or 345.67 points to 6,652.54 points and life insurance sub-index jumped 2.86 per cent or 236.83 points to 8,516.57 points.

Mutual funds gained 2.69 per cent or 0.28 point to 10.68 points.

Banking, the subgroup with highest weightage in the country’s sole secondary market, went up 1.85 per cent or 21.82 points to 1,201.73 points. Others trailed with a rise of 1.83 per cent or 14.54 points to 809.43 points.

Development banks ascended 1.55 per cent or 26.94 points to 1,765.55 points. Microfinance climbed 1.27 per cent or 29.87 points to 2,377.62 points and hydropower was up 1.23 per cent or 11.58 points to 955.42 points.

Manufacturing inched up 0.77 per cent or 20.81 points to 2,713.49 points and finance edged up 0.74 per cent or 4.84 points to 659.13 points.

Nepal Reinsurance Co was the leader in terms of trading volume and weekly turnover, with 798,000 of its stocks changing hands that amounted to Rs 466.20 million.

Nepal Life Insurance Co with Rs 398.87 million, Ajod Insurance Ltd with Rs 264.23 million, NIC Asia Bank with Rs 250.33 million and NMB Bank with Rs 214.59 million rounded up the top five firms to record the highest weekly turnover in the review period.

In terms of trading volume, Nepal Bank was second with 713,000 shares traded, Ajod Insurance was third with 525,000 shares, NMB Bank was fourth with 508,000 shares and NIC Asia Bank was fifth with 439,000 shares.

Meanwhile, Ajod Insurance was the forerunner in number of trades, with 36,032 transactions. It was followed NIC Asia Laghubitta Bittiya Sanstha with 10,348, Nepal Reinsurance with 10,181, Nepal Life Insurance with 2,404 and NMB Bank with 2,389 transactions.

A version of this article appears in e-paper on August 16, 2020, of The Himalayan Times.