Debt burden of each Nepali falls by Rs 1,731

KATHMANDU, July 12

Debt burden of each Nepali fell by Rs 1,731, or 8.62 per cent, in the current fiscal year, indicating the government is depending less on borrowings to cover various costs.

Each Nepali, on average, carried a national debt Rs 20,068 in the last fiscal year. This figure fell down to four-year low of Rs 18,337 this fiscal, shows the Economic Survey 2014-15 presented today by Finance Minister Ram Sharan Mahat at Parliament.

The portion of national debt currently carried by each Nepali is equivalent to 24 per cent of per capita gross national income of Rs 76,065.

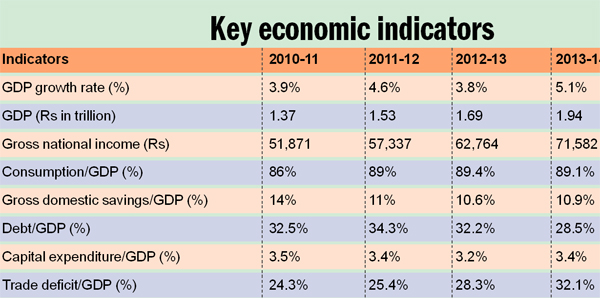

As debt burden of each Nepali fell, Nepal’s debt to gross domestic product ratio also dipped to over two-decade low of 24.5 per cent this fiscal year. A comfortable debt-GDP ratio will provide the government ample space to rely on borrowing to finance development activities, which is crucial at a time when the country is trying to make early recovery from devastating earthquakes of April and May.

The country’s debt-GDP ratio stood at an alarming level of 69.7 per cent in fiscal year 2001-02. Since then Nepal has been gradually reducing its reliance on domestic and external borrowings to cover various public costs. At the same time, loan repayments are also being made on time.

The government repaid Rs 13.03 billion of external debt, including principal and interest, from the beginning of this fiscal to mid-April. It has also repaid Rs 42.55 billion of domestic debt so far this fiscal.

With these repayments, the ratio of external debt to GDP has fallen to 15.4 per cent, while the ratio of domestic debt to GDP hovers around 9.1 per cent, shows the Economic Survey. While lower debt-GDP ratio indicates the country is maintaining good fiscal discipline — which eventually contributes to macroeconomic stability —what appears worrying is higher contribution of consumption to GDP.

Although contribution of consumption to GDP fell to four-year low this fiscal, it still stands at a whopping 88.6 per cent.

Such high level of consumption probably would not have been a cause of concern had a sizeable portion of those goods been manufactured in the country. But Nepal is a net-importing country and most of the goods that are consumed are brought in from foreign countries. Higher reliance on foreign goods probably would not have raised eyebrows had Nepal been able to offset the impact of imports by raising exports. But the country has not been able to do that.

As a result, for every rupee of exports, Nepal has imported Rs 11.3 worth of merchandise goods so far this fiscal year. A country with such an alarming level of export-import ratio probably would have faced crisis of foreign currency. But thanks to money sent by Nepalis working abroad, the country’s foreign exchange reserve can finance merchandise imports of a whopping 12.6 months. This indicates remittance is fuelling consumption.

Remittance as percentage of GDP stood at 27.7 per cent in the current fiscal year, as against 28 per cent in the last fiscal. The remittance-GDP ratio fell moderately this fiscal because of deceleration in the flow of money sent by Nepalis working abroad, largely because of reliance on informal channels to send funds home’.