Election optimism fuels secondary market

Investors are not anxious about next leadership as they already know what to expect from whom

The secondary market jumped by nearly three per cent in the trading week between November 26 and 30, amid two elections of provincial and the Legislature-Parliament. The first phase of the election was held on November 26 and the second phase is slated to be held on December 7.

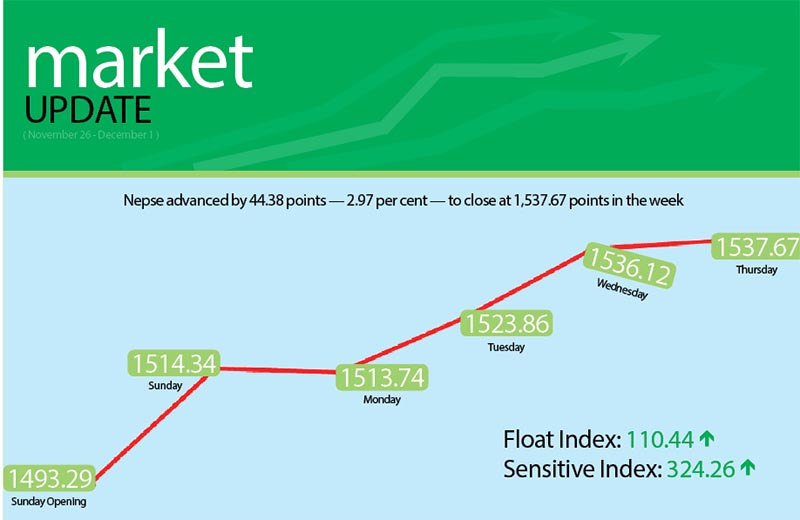

The Nepal Stock Exchange (Nepse) index advanced by 2.97 per cent or 44.38 points in the review period.

Along with the Nepse index, the sensitive and the float indices also went up in the week. The sensitive index landed at 324.26 points, up 9.83 points or 3.13 per cent and the float index rested at 110.44 points, with a rise of 3.15 points or 2.94 per cent.

The benchmark index had opened at 1,493.29 points on Sunday and closed at 1,514.34 points at the end of the day. As per data maintained by Nepse, the secondary market had bounced back above 1,500 points after seven trading days. The last time the market had closed above that threshold was on November 16 when the benchmark index had rested at 1,504.79 points.

However, on Monday the market fell slightly and closed at 1,513.74 points. The market rebounded on Tuesday and closed at 1,523.86 points, and continued northbound for the remainder of the week. The secondary market rose to 1,536.12 points on Wednesday and to 1,537.67 points on Thursday.

With the completion of the first phase of the election, investors are hopeful that the market will rise further in the days to come.

Nawaraj Subedi, chairman of Nepal Stock Market Investors Association, said that investors have taken smooth completion of the first phase election on a positive note. “There may be nominal fluctuations in the market in the next few days, but ultimately we expect the market to rise,” he said.

The government’s development expenditure will also be boosted after the elections, which will help to pull down the interest rate and is also expected to add to investors’ optimism. “We expect that the government formed after the elections will enhance the development expenditure, which will help in the flow of liquidity in the market and bring down the interest rates,” Subedi added. “Investors are not really anxious about the next leadership as they already know what to expect from whom.”

Majority of the sub-indices landed in the green during the trading week.

The sub-index of class ‘A’ financial institutions went up to 1,311.83 points, increasing by 31.65 points or 2.47 per cent. Share price of Nepal Bank surged by 6.76 per cent to Rs 379 per unit, secondary market price of Standard Chartered Bank rose by 2.91 per cent to Rs 2,120 per unit and share price of Nabil Bank went up 1.11 per cent to Rs 1,179 per unit in the review period.

The others sector advanced by 6.78 per cent or 56.67 points to land at 891.92 points. This was primarily on the back of share price of Nepal Telecom soaring by 7.12 per cent to Rs 904 per unit. Similarly, share price of Hydroelectricity Investment and Development Co Ltd also went up to Rs 186 per unit, increasing by 4.94 per cent.

The hydropower sector rose by 8.15 per cent or 156.62 points to 2,078 points. Share price of Chilime Hydropower Company climbed up by 9.12 per cent to Rs 951 per unit and secondary market price of Butwal Power Company went up by 12.15 per cent to Rs 729 per unit.

Likewise, sub-index of hotels sector rose by 3.51 per cent or 73.7 points in the week to 2,176.06 points. Similarly, the insurance sector closed at 8,137.21 points, increasing by 156.12 points or 1.96 per cent during the week.

The finance sector gained 1.17 per cent or 8.82 points to 762.29 points and the development banks sub-index rose by 1.27 per cent or 22.29 points to 1,775.09 points. Likewise, the microfinance sector gained 4.91 per cent or 87.29 points to 1,863.64 points in the review period.

Meanwhile, the manufacturing and the trading group fell in the week. The manufacturing sector dipped by 1.92 per cent or 47.57 points to 2,430.32 points whereas the trading group decreased by 6.59 points or 3.06 per cent to 209.04 points in the review period.

Altogether, 6.82 million shares worth Rs 3.65 billion were traded through 31,941 transactions during the week.