Investor sentiment hits Nepse, down by 1.35pc

Kathmandu, November 23

With investors getting more and more frustrated with the government apathy regarding the concerns they have raised, the country’s sole secondary market has failed to rebound.

According to Uttam Aryal, chairperson of Investors Association of Nepal, the finance minister and his policies are to be blamed for the bearish trend.

Stating that shareholders have lost as much as Rs 500 billion over the past two years, he said “We need a clear perspective from the finance minister regarding the share market.”

As per him, while share investors were already wary of his flip-flop policies, the finance minister has recently been turning a deaf ear to the genuine concerns of share investors. “If the finance minister were to be replaced, the share market will go on a bull run,” he claimed.

Aryal further said that buying pressure has gone up slightly in recent days, but that this was all in the hope of the tenure of the current finance minister ending in a few months.

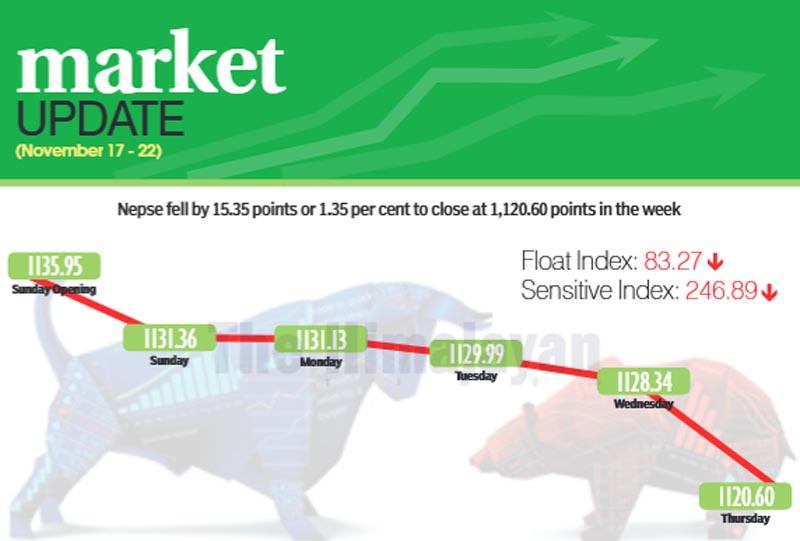

In the review week between November 17 and 21, Nepal Stock Exchange (Nepse) index fell by 1.35 per cent or 15.35 points to 1,120.60 points.

Sensitive index also descended by 1.27 per cent or 3.18 points to 246.89 points. The float index also dipped by 1.27 per cent or 1.07 points to 83.27 points.

The weekly turnover decreased by 8.91 per cent as compared to the previous week to Rs 1.57 billion. In the previous week, the market had witnessed transactions worth Rs 1.72 billion. The trading volume also went down to 5.52 million stocks changing hands this week from 5.82 million in the previous week. The number of transactions, however, rose by 2.6 per cent to 26,143 transactions from 25,481 in the preceding week.

The benchmark index had opened on Sunday at 1,135.95 points. It had dropped by 4.59 points by end of the first trading day. The market remained southbound throughout the week — dipping by 0.23 point on Monday, down 1.14 points on Tuesday, 1.65 points on Wednesday and 7.74 points on Thursday to finally settle at 1,120.60 points for the week.

In the review week, trading and others subgroups landed in the green zone.

Trading subgroup was the biggest gainer of the week, jumping by a whopping 42.61 per cent or 155.72 points to 521.18 points. This was on the back of share price of Salt Trading Corporation surging by Rs 573 to Rs 1,516 and that of Bishal Bazzar Company by Rs 26 to Rs 1,419.

Similarly, others subgroup went up by 0.27 per cent or 1.73 points to 636.16 points.

“Share investors have been making ‘safe bets’, which is why they have been swarming towards trading companies,” explained Aryal.

Conversely, manufacturing sub-index was the biggest loser of the week — slumping by 7.80 per cent or 191.21 points to 2,259.76 points, weighed down by share value of Unilever Nepal falling Rs 783 to Rs 19,013.

Hydropower subgroup lost 3.19 per cent or 30.13 points to 914.23 points and non-life insurance sub-index fell by 2.33 per cent or 97.26 points to 4,061.59 points.

Similarly, finance subgroup fell by 1.43 per cent or 8.08 points to 557.15 points. The mutual funds sub-index fell by 1.39 per cent or 0.13 point to 9.18 points and microfinance sub-index went down by 1.28 per cent or 19.07 points to 1,473.67 points.

The life insurance subgroup dropped by 1.19 per cent or 59.95 points to 4,955.24 points.

Similarly, hotels sub-index went down by 1.10 per cent or 19.60 points to 1,755.88 points.

Banking subgroup fell by 1.04 per cent or 10.85 points to 1,031.19 points and development banks shed 0.57 per cent or 8.85 points to 1,535.61 points.

In the review week, Nepal Bank was the forerunner in terms of trading volume and weekly turnover, with 568,000 of its shares changing hands that amounted to Rs 181.64 million.

NMB Bank with Rs 179.85 million, NIC Asia Bank with Rs 83.56 million, Shivam Cements with Rs 76.72 million and Nabil Bank with Rs 64.49 million rounded up the top five companies with highest turnover in the review period.

In terms of weekly trading volume, other top companies were NMB Bank with 467,000 shares, NIC Asia Bank with 202,000 shares, Shivam Cements with 177,000 shares and Prabhu Bank with 160,000 shares.

Meanwhile, NMB Bank topped in terms of number of transactions with 1,533 deals. It was followed by Nepal Bank with 1,464, Sanjen Jalavidhyut with 1,278, Rashuwagadhi Hydropower with 1,230 and Shivam Cements with 1,124 transactions.