Lending of BFIs rebounds strongly

Kathmandu, May 20

Lending of banks and financial institutions (BFIs) has rebounded strongly, as demand for new loans jumped by Rs 60.52 billion in the ninth month of this fiscal year alone.

The new credit extended by BFIs in the ninth month of this fiscal between mid-March and mid-April is almost 30 per cent of the total new loans issued in first nine months of the current fiscal.

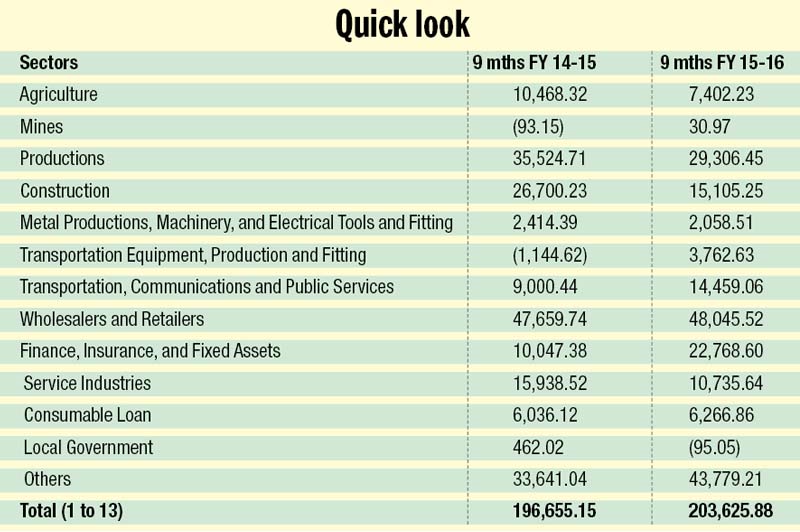

BFIs extended Rs 203.63 billion in new loans in the first nine months of the current fiscal from mid-July to mid-April, show the latest data of Nepal Rastra Bank (NRB), the central bank. In the same period a year ago, BFIs extended Rs 196.66 billion in new loans.

This marks lending growth of 3.54 per cent and a strong rebound from the eight-month period when new loan expansion recorded a negative growth of 12 per cent.

“Demand for credit is lately growing as the supply situation has completely normalised,” Sanima Bank CEO Bhuvan Dahal said. “This is an indication that economic activities are gradually picking up.”

Credit demand had slumped soon after the beginning of the fiscal year largely due to blockade on Nepal-India border points, which hit supplies of everything from raw materials and petroleum products to capital goods and other essentials. This put a brake on almost every economic activity in the country.

But with the formal lifting of blockade on February 8, normalcy is gradually being restored in almost every sector. Also, public spending on development activities, especially construction, is going up, as the fiscal year is drawing to an end, creating demand for loans.

NRB data show that wholesale and retail sector, which accounts for around 22 per cent of total lending, absorbed Rs 15.86 billion in new loans in the ninth month of the current fiscal.

Also, production sector, which contributes to around 18 per cent of the total lending, soaked up Rs 5.87 billion in new loans in one-month period between mid-March and mid-April. Similarly,

Rs 4.90 billion in new loans were extended to construction sector, which accounts for 10.7 per cent of total lending, in between mid-March and mid-April of this fiscal.

Despite higher demand for loans from these crucial sectors, aggregate credit expansion in production and construction sectors remained in negative territory in first nine months of current fiscal year.

In the production sector, for instance, Rs 29.31 billion in new loans were issued in the first nine months of current fiscal, as against Rs 35.52 billion in the same period a year ago.

Similarly, Rs 15.10 billion in new loans were extended to the construction sector in the nine-month period of this fiscal, as against Rs 26.70 billion in the same period a year ago.

Bankers are not sure whether these gaps can be filled by end of this fiscal as demand for new loans generally does not go up in the last month of financial years.