Negative remittance growth could exert pressure on country’s BoP

The country has witnessed negative growth in remittances in the first four months of this fiscal year, which could have an adverse impact on various sectors of the economy. Unveiling the first quadrimester’s macro economic outlook, Nepal Rastra Bank (NRB) has said that it could exert pressure on the Balance of Payments (BoP), which was at a marginal surplus of Rs 2.40 billion in the review period.

However, the current account is already negative by Rs 25.81 billion in the review period due to skyrocketing imports against sluggish exports. The country’s BoP situation was surplus with Rs 21.98 billion and the current account surplus was Rs 1.86 billion in the corresponding period of previous fiscal.

Remittances, which have been lubricating the Nepali economy since the early 2000’s along with rising outmigration of the youth population from the country, plunged to negative growth territory for the first time following the global economic crisis of 2009, which impacted the Gulf economy along with oil price shocks.

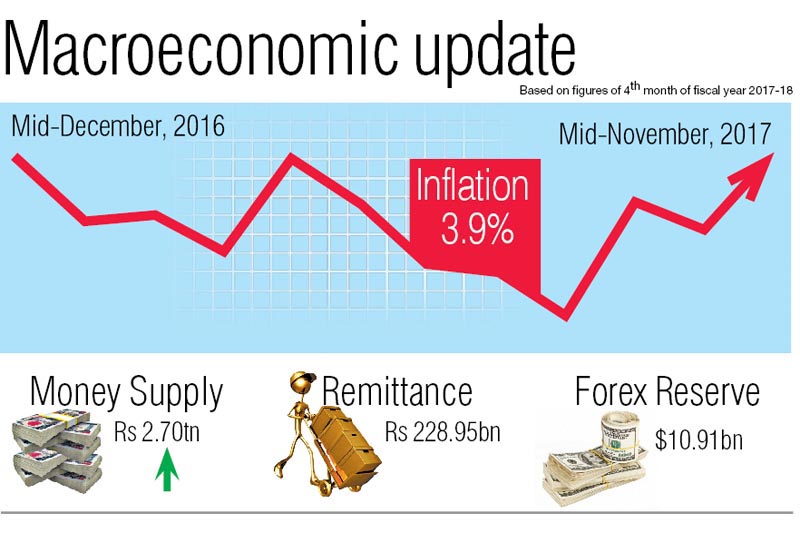

As per the central bank, the country received remittance worth Rs 228.95 billion in the first quadrimester of this fiscal compared to Rs 232.14 billion of the corresponding period of the last fiscal. Remittance recorded negative growth of 1.4 per cent in the review period, whereas it was 7.8 per cent in first quadrimester of the last fiscal as compared to previous fiscal.

Decline in remittances will have an adverse impact on the economy as the banking system is already in a crisis regarding fresh sources of deposits, which could be remittances. Negative growth of remittances will hamper the loan expansion plan of the banks including trade financing (letter of credit businesses for imports). This might create a situation of contraction in imports in the coming days and government’s revenue that is generated from imports could be affected, as per economists.

Skyrocketing imports against sluggish exports is the major reason behind the widening current account deficit in the fourth month. The current account registered a deficit of Rs 21.94 billion in the third month of this fiscal, which has widened to Rs 25.81 billion in the review period, as per the NRB report. The country’s imports surged by 10.8 per cent in the first four months to Rs 334.31 billion against the export growth of 7.5 per cent to Rs 26.35 billion. The trade deficit has widened to Rs 307.96 billion.

On the other hand, consumer price inflation slightly picked up to 3.9 per cent along with increased money supply as political parties and the Election Commission spent a huge sum of money for the elections. “Despite inflation wedge of one percentage point between Nepal and India, increment in price of vegetables and alcoholic drinks, among others, has contributed to the acceleration of inflation in the review month as compared to 3.1 per cent in mid-October,” the NRB report states.