Nepse edges up 1.2 per cent

The Nepal Stock Exchange (Nepse) index gained 12.38 points or 1.2 per cent week-on-week, from August 2 to 6, on the back of stock investors swarming towards scrips of commercial banks and insurance companies.

“Investors view on insurance companies has changed after the quake, which has drawn them towards the insurance stock,” informed Dipak Karki, a stock market analyst, adding the recent directive from Nepal Rastra Bank requiring banks and financial institutions (BFIs) to prop up their paid-up capital has also aided the bull run. “Even as there are some reservations regarding the timeframe given to BFIs to abide by the new rule, the provision is overall positive.”

He further said that since the stock market has reached a certain maturity, there are less chances of massive volatility in the coming days. “The stock market has withstood the effects of the earthquake and political developments, which indicates market maturity.”

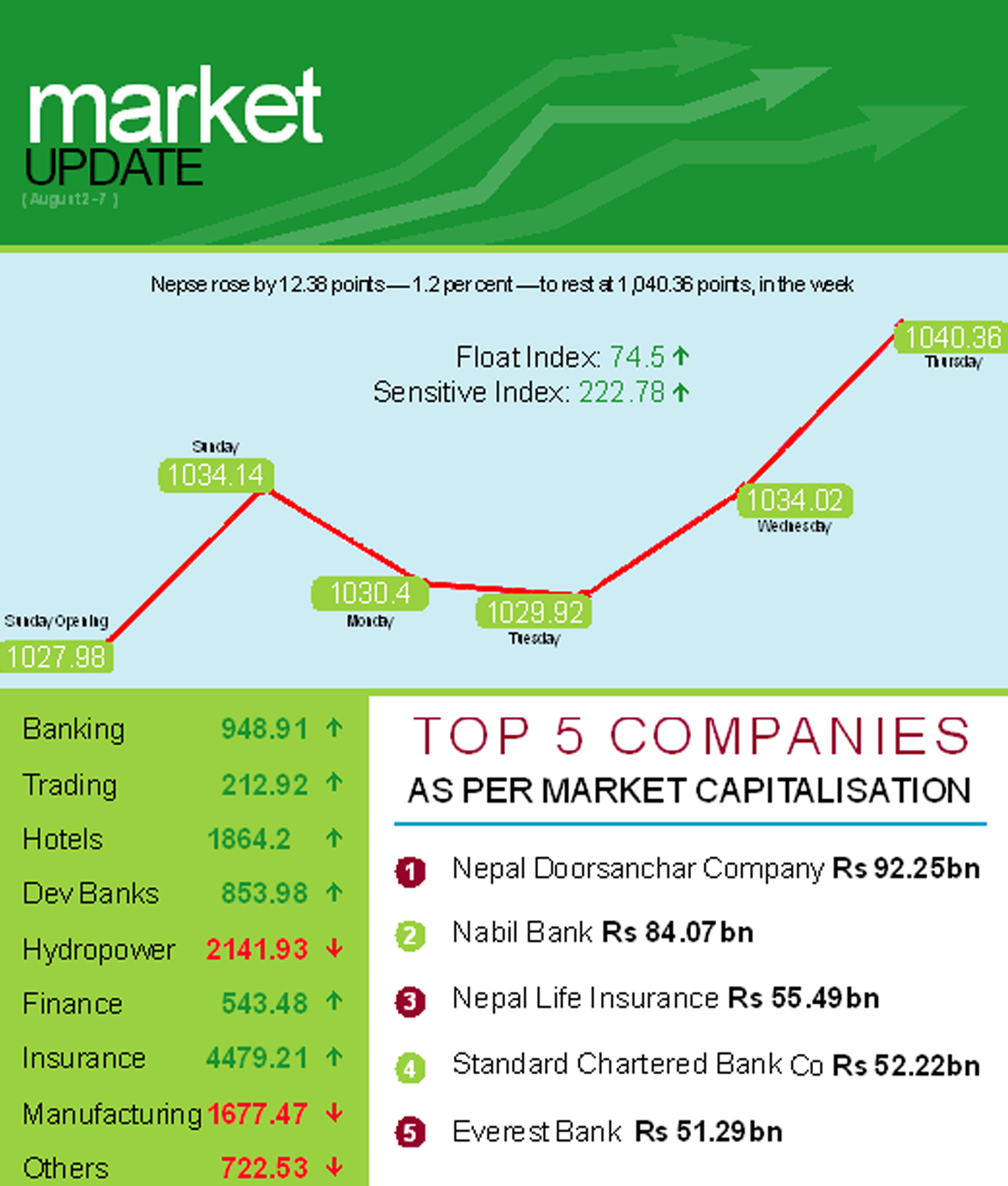

Opening at 1,027.98 points on Sunday, the benchmark index added 6.16 points by the day’s closing. On Monday and Tuesday, Nepse shed 3.74 points and 0.48 points, respectively. However, the local bourse more than recovered all of the loss over the last two trading days, edging up by 4.1 points and 6.34 points on Wednesday and Thursday, respectively.

Altogether 4.84 million units of shares of 172 companies worth Rs 2.48 billion were traded in the country’s only secondary market during the trading week through 17,482 transactions. The traded amount was 18.25 per cent less than the preceding week when 7.19 million scrips of 174 listed firms worth Rs 3.03 billion had changed hands in 15,416 deals.

The sensitive index, which gauges the performance of class ‘A’ stocks, went up by 1.8 points to 222.78 points. Similarly, the float index that measures the performance of shares actually traded also added one point to close at 74.5 points during the review period.

Most of the subgroups witnessed gains during the trading week. However, others, manufacturing and hydropower recorded losses.

Insurance was the top gainer in the week, surging by a massive 224.34 points to 4,479.21 points. Share value of National Life Insurance soared by Rs 126 to Rs 2,015 and of Life Insurance Co Nepal by Rs 289 to Rs 3,190, among others.

Hotels reversed some of the loss of the previous week by adding 15.71 points to land at 1,864.2 points. Even as Taragaon’s scrips dipped by Rs 10 to close at Rs 245, the loss was offset by Oriental gaining Rs 13 to Rs 613 and Soaltee edging up by five rupees to Rs 430.

Banking ascended by 11.52 points to 948.91 points, with the share value of Himalayan Bank rising to Rs 1,078, up Rs 98, and of Sanima Bank up Rs 34 to Rs 648.

Trading went up by 6.58 points to 212.92 points, primarily with Bishal Bazaar Co’s scrips gaining Rs 78 to Rs 2,184.

Development banks too managed to land in the green terrain, adding 4.08 points to 853.98 points. Nagbeli’s share value went up by Rs 43 to Rs 2,234 and of Nirdhan Utthan Bank by Rs 74 to Rs 1,509.

Finance inched up 1.33 points to 543.48 points.

Meanwhile, a drop of Rs 13 in the share value of Nepal Telecom weighed on the others index, which descended by 15.27 points to 722.53 points.

Manufacturing shed 8.36 points to 1,677.47 points as Unilever’s shares lost Rs 161 to Rs 21,400.

Similar to the previous week, hydropower subgroup continued southbound, but managed to limit its loss to a minimal 2.75 points to rest at 2,141.93 points. Even though Chilime’s scrips rose by nine rupees to Rs 1,581, Butwal Power’s share value dropping by Rs 19 to Rs 600 and of Arun Valley’s by Rs 13 to Rs 300 dragged the sub-index down.

Nepal Investment Bank (Promoter Share) secured the top spot in terms of number of shares traded and turnover, with 574,000 of its scrips worth Rs 338.34 million changing hands. Everest Bank with Rs 120.79 million, Himalayan Bank with Rs 85.58 million, Nepal Life Insurance with Rs 83.26 million and Nabil Bank with Rs 80.29 million rounded up the top five listed companies that recorded highest turnover during the trading week.

Meanwhile, Prime Commercial Bank was the forerunner in regards with number of transactions, clocking 823 deals.