Nepse index sees mostly horizontal movement

The Nepal Stock Exchange (Nepse) index saw mostly horizontal movement in the week of April 23 to 27, as the bull and bear engaged in intense tug of war.

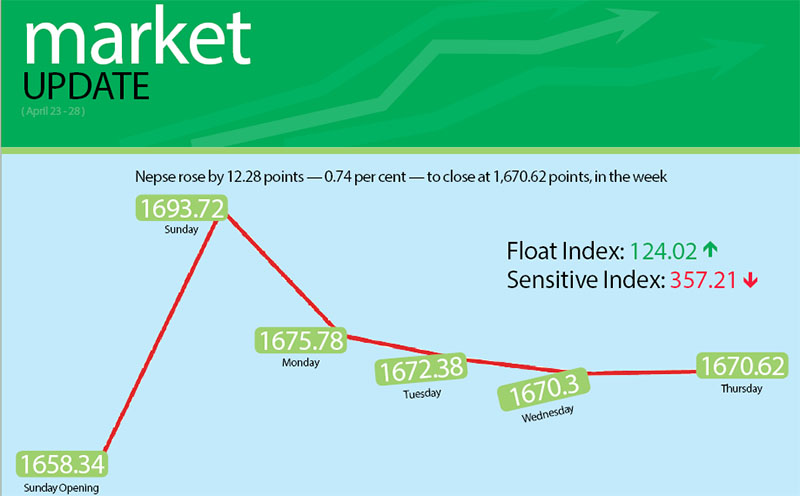

Opening at 1,658.34 points on Sunday, the benchmark index had surged by 35.38 points by the day’s closing as positive political cues reverberated through the secondary market and boosted investor sentiment. The optimism, however, was short-lived as Nepse dropped by 17.94 points the next day. The local bourse started to stabilise on Tuesday, with Nepse index shedding 3.4 points, and dipping again by 2.08 points on Wednesday. On Thursday, the local bourse inched up 0.32 point to close the week at 1,670.62 points — a gain of 12.28 points or 0.74 per cent during the course of five trading days.

The sensitive index, which gauges the performance of class ‘A’ stocks, fell by 0.82 point or 0.23 per cent to 357.21 points. The float index that measures the performance of shares actually traded, on the other hand, inched up 0.07 point or 0.05 per cent to 124.02 points.

Altogether, 8.20 million shares of 156 firms that totalled Rs 5.69 billion were traded through 41,898 transactions in the week. The traded amount was 9.88 per cent higher than the previous week when 33,831 transactions of 7.52 million shares of 154 companies that amounted to Rs 5.18 billion had been undertaken. It has to be noted though that the share market had remained open for only four days in the past week due to a public holiday.

Even as most of the subgroups witnessed gains during the review period, the dip recorded by the banking sub-index — the share market heavyweight — weighed on the benchmark index.

Banking fell by 9.91 points or 0.64 per cent to rest at 1,525.96 points. Likewise, others slipped 2.02 points or 0.3 per cent to 675.04 points.

After slumping by 2.04 per cent in the previous week, stock investors rushed to capitalise on the reduced shares of insurance companies. This resulted in the insurance subgroup taking the lead among the gainers with a surge of 362.79 points or 4.17 per cent to 9,050.86 points.

Finance more than recovered the dip of 0.06 per cent of the past week, as subgroup ascended 23.95 points or 3.15 per cent to 785.16 points.

Hotels too recouped the earlier loss of 0.61 per cent by climbing 51.3 points or 2.34 per cent to 2,243.92 points. Trailing close behind, development banks rose by 39.71 points or 2.05 per cent to 1,978.98 points.

Even trading, which had remained stagnant at 209.25 points since April 3, advanced by 2.1 points or one per cent.

The gains witnessed by hydropower and manufacturing subgroups were less than one per cent. Hydropower added 19.19 points or 0.96 per cent to close at 2,009.49 points, while manufacturing inched up 5.92 points or 0.27 per cent to 2,167.37 points.

Meanwhile, Prabhu Bank secured the top position in terms of trading volume and turnover, with 547,000 of its shares changing hands that amounted to Rs 239.18 million. The other companies with highest turnover during the review period were Prime Life Insurance with Rs 236.41 million, Siddhartha Insurance

with Rs 199.80 million, Nepal Life Insurance with Rs 165.45 million and Nepal Credit and Commerce Bank with Rs 165.12 million.

Arun Kabeli Power Ltd topped the chart with regard to most number of transactions — 5,621.