Positive political cues push Nepse up 0.98pc

Kathmandu, February 13

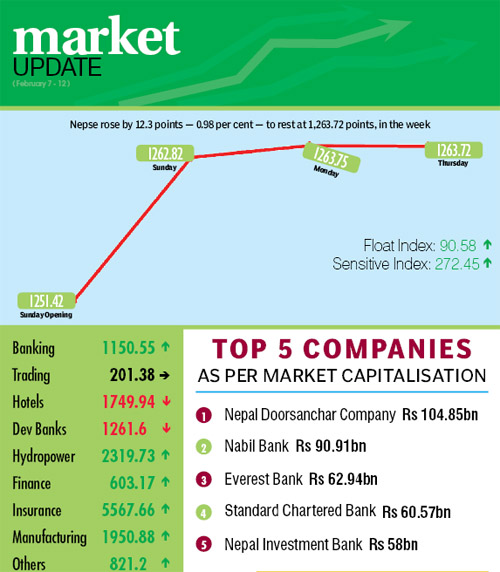

The optimism of stock investors got a boost owing to encouraging development on the political front with the agitating Madhes-based parties withdrawing their border blockade. Consequently, Nepal Stock Exchange (Nepse) index clocked a weekly gain of 12.3 points or 0.98 per cent to rest 1,263.72 points, from February 7 to 11.

Opening at 1,251.42 points on Sunday, the benchmark index had surged by 11.4 points by the day’s closing to record an all-time high of 1,262.82 points. On Monday, Nepse added another 0.93 points to close at a fresh high of 1,263.75 points.

The country’s only secondary market remained closed on Tuesday and Wednesday. On Thursday, local bourse shed 0.03 points to rest at 1,263.72 points.

“The recent quarterly reports of various companies, especially banking institutions, showed profits even during the difficult times . This has boosted investors’ confidence,” explained Rabindra Bhattarai, a stock market analyst.

He further said that due to low lending rates of banks and financial institutions, the benchmark index may surge in the coming days and the chances of market correction in the immediate future is minimal.

Altogether 3.3 million shares of 130 companies worth Rs 1.90 billion were traded through 10,107 transactions in the review period. The traded amount was 31.97 per cent less than the preceding week, when 13,922 transactions of 4.47 million scrips of 128 companies that amounted to Rs 2.80 billion had been undertaken.

Sensitive index rose 1.09 per cent to 272.45 points. Similarly, the float index also went up 1.04 per cent to 90.58 points during review period.

Among the subgroups, trading held steady at 201.38 points, while development banks and hotels subgroups landed in the red.

Hydropower led the pack of gainers, soaring by 6.45 per cent to 2,319.73 points. Chilime’s share value surged by Rs 117 to Rs 1,407, Api gained Rs 91 to Rs 540 and Barun was up Rs 36 to Rs 352.

Insurance subgroup went up 1.85 per cent to 5,567.66 points. Share price of Nepal Life Insurance rose Rs 15 to Rs 3,225, that of Asian Life by Rs 30 to Rs 1,330, of Everest Insurance by Rs 30 to Rs 1,010.

With Unilever Nepal’s stock value rising by Rs 540 to Rs 27,577, the sub-index of manufacturing went up 1.46 per cent to 1,950.88 points.

Others subgroup added 1.16 per cent to land at 821.2 points on the back of Nepal Telecom’s share price up eight rupees to Rs 699.

Banking sub-index rose by 1.14 per cent to 1,150.55 points. Everest gained Rs 60 to Rs 2,400, Nepal Investment was up Rs 42 to Rs 914.

Finance subgroup edged up 0.25 per cent to 603.17 points.

Meanwhile, development banks — which had led the market rally in the previous week — dropped 2.51 per cent to 1,261.6 points. Nagbeli plunged by Rs 190 to Rs 3,500, Swabalamban dived by Rs 160 to Rs 2,130, among others.

Hotels fell 1.21 per cent to 1,749.94 points, weighed by Soaltee down four rupees to Rs 326 and Oriental down Rs 10 to 449.

Nepal Bank topped the chart in terms of turnover with Rs 91.32 million, followed by Nepal Investment Bank (Rs 88.09 million), Rural Microfinance Development Centre (Rs 82.04 million), Neco Insurance (Rs 71.45 million) and Asian Life Insurance (Rs 66. 5 million).

National Hydropower was the forerunner in terms of shares traded with 368,000 of its scrips changing hands. Meanwhile, Rural Microfinance Development Centre topped the chart in terms of transactions with 544 deals.