Private investor confidence down

Public investment not attracting enough private capital spending

Kathmandu, May 26

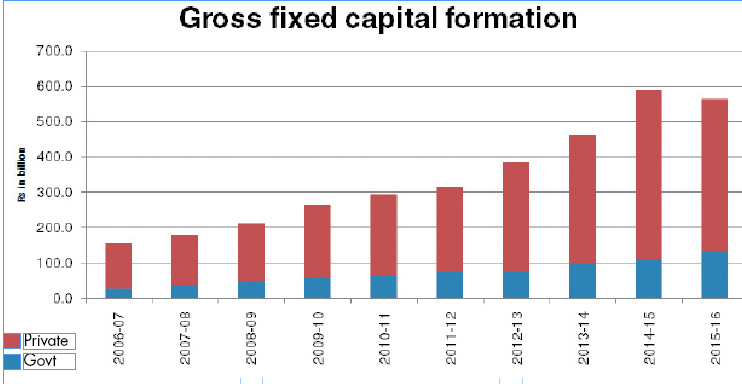

Higher investment made by the government in fixed capital assets, excluding land, is unlikely to draw adequate investment from the private sector in the current fiscal, signalling erosion in private investor confidence.

The government’s investment in fixed capital assets is projected to jump by 20.4 per cent to Rs 132.8 billion (in current prices) in the current fiscal, shows the Economic Survey released today by the Ministry of Finance.

“Higher public spending in capital assets is good news, as such investment helps redress market failures and magnifies the power of private investment,” said Swarnim Wagle, senior economist and former member of the National Planning Commission.

But rise in public investment is not expected to accelerate private investment in Nepal in this fiscal, as private sector’s contribution in fixed capital formation is likely to drop by 10.1 per cent to Rs 429.7 billion.

This means for every rupee of investment made by the government in fixed capital assets this fiscal, the private sector is likely to create fixed capital assets worth Rs 3.2.

This ratio is the lowest in at least 10 years.

In the last one decade, every rupee of investment made by the government in fixed capital assets, on average, helped the private sector to create fixed capital worth Rs 4. This figure stood at Rs 4.3 in the last fiscal year, shows the survey.

“Public investments are usually strategic meaning the government, at times, is compelled to make use of funds to fulfil various obligations. But private investment is discretionary and investors make careful decisions before spending a penny.

The latest data clearly indicate that private investors are not very excited at the moment because mid-term economic outlook appears bleak,” said Wagle.

As the contribution of private sector in fixed capital formation is expected to take a dip, the country’s gross fixed capital formation, in this fiscal, is likely to decelerate for the first time in at least a decade to Rs 562.5 billion.

This amount is 25.01 per cent of the gross domestic product of Rs 2,248.7 billion, which means Nepal is likely to use only a fourth of the GDP to build capital assets, like hydropower plants, roads, irrigation projects, airports and bridges, that are critical for economic growth, while the rest will be exhausted in consumption.

In the last fiscal year, gross fixed capital formation as percentage of GDP stood at 27.75 per cent.

“Global evidence shows that gross fixed capital formation accounts for 3/4th of the economic growth in low-income countries, like Nepal.

The share of gross fixed capital formation in GDP growth gradually starts to decline once the country transforms into a mid-income economy, where other factors, like research, innovation and broader application of skills, play a greater role in triggering growth,” Wagle said, adding, “Since Nepal still falls in low-income category, deceleration in capital formation does not bode well.”

One of the reasons for possible deceleration in gross fixed capital formation this fiscal is the blockade at Nepal-India border points, which affected almost every economic activity and hit the private sector hard.

Also, failure to create an enabling environment for investment and continuous delay in introducing a host of policy reforms have also hit the capital formation process.