Benchmark index moves in conjunction with political development

Kathmandu, November 21

The country’s only secondary market saw nearly all the gains witnessed in the previous trading week wiped out as the political deadlock and the ensuing crisis dampened investor sentiment.

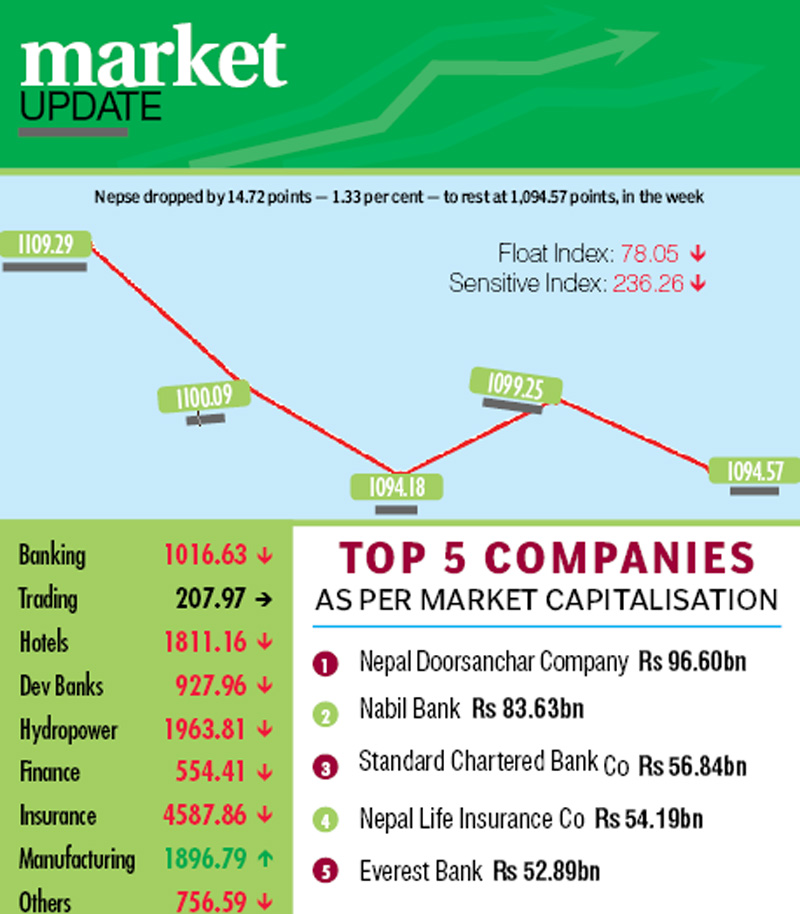

The Nepal Stock Exchange (Nepse) index dropped 14.72 points or 1.33 per cent week-on-week to rest at 1,094.57 points, from November 15 to 19. In the earlier trading week, the benchmark index had managed to surge by 18.61 points or 1.71 per cent on news and speculations of a possible breakthrough in the talks with the agitating Madhes-based parties.

Opening after the Tihar festival on Sunday at 1,109.29 points, the Nepse index had fallen 9.2 points by the day’s closing. The downward trajectory continued on Monday as well, with the benchmark index shedding another 5.91 points to retreat below the threshold of 1,100 points again.

The stock market remained closed on Tuesday in celebration of Chhath festival.

On Wednesday, the local bourse nearly recovered all of the loss of the previous trading day by adding 5.07 points on hopes that the dialogue with the agitating parties would resolve the contentious issues.

However, the optimism was short-lived as the Madhesi forces’ talks with ruling parties ended inconclusively and it

was announced that the border blockade would continue. Thus, Nepse dipped again by 4.68 points on Thursday.

In total, 1.59 million shares of 143 companies worth Rs 758.23 million were traded through 4,868 transactions. In the preceding week, when the market remained open for only three days before the Tihar holidays, altogether 3,934 transactions of 1.84 million scrips that amounted to Rs 628.05 million had been undertaken.

The sensitive index, which gauges the performance of class ‘A’ stocks, descended by 3.34 points to 236.26 points. Likewise, the float index that measures the performance of shares actually traded also dipped by 1.19 points to 78.05 points, during the review period.

While trading continued to remain constant at 207.97 points, manufacturing was the only subgroup to witness any gain. Unilever Nepal’s stock price rose by Rs 250 to

Rs 26,250, which helped nudge up the manufacturing sub-index by a marginal 0.68 per cent to 1,896.79 points.

On the other hand, hydropower slumped by 2.03 per cent to 1,963.81 points as Chilime’s share value went down by

Rs 43 to Rs 1,367 and Barun’s was down Rs 31 to Rs 366, among others.

With commercial banks like Everest dropping Rs 89 to Rs 2,681 and Nabil down Rs 22 to Rs 2,288, the banking subgroup fell 1.67 per cent to 1,016.63 points.

Insurance firms also took a beating, which weighed on the insurance subgroup. The sub-index was down 1.56 per cent to 4,587.86 points. Stock price of National Life Insurance dropped by Rs 58 to Rs 2,132 and of Nepal Life Insurance by Rs 74 to Rs 3,125, among others.

Reversing the previous week’s ascent, hotels fell 1.20 per cent to 1,811.16 points due to Oriental’s share value plunging by Rs 117 to Rs 435 and Soaltee’s dipping by three rupees to Rs 427.

Nepal Telecom’s stock price slipped by three rupees to Rs 644, which in turn caused others subgroup to edge down 0.46 per cent to 756.59 points.

Development banks and finance subgroups also witnessed muted losses — shedding 0.64 per cent to land at 927.96 points and 0.10 per cent to 554.41 points, respectively.

Everest Bank topped the chart with the highest turnover of Rs 48.18 million, followed by Business Universal Development Bank with Rs 40.46 million, Citizens Bank International with Rs 33.76 million, Nepal Life Insurance Co with Rs 31.87 million and Sana Kisan Bikas Bank with Rs 29.02 million.

Business Universal Development Bank was the forerunner in terms of number of shares traded with 156,000 of its scrips changing hands. Arun Hydropower recorded the most number of transactions — 418.