Nepalis’ savings habit worst in 2 decades

Kathmandu, May 3

Savings habit of Nepalis is currently at its worst in at least two decades, as they have started consuming almost everything that is being produced in the country.

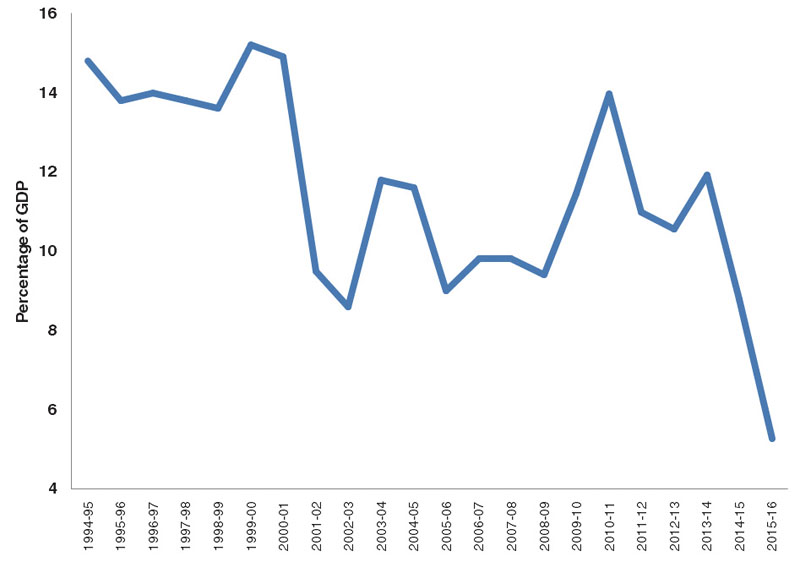

Gross domestic savings as percentage of gross domestic product (GDP) is likely to stand at 5.26 per cent in the current fiscal year, according to the Central Bureau of Statistics, as the country has failed to enhance its productive capacity.

The figure is the lowest since fiscal year 1994-95. Data prepared before 1994-95 were not available.

Nepal’s GDP is projected to stand at Rs 2.25 trillion in the current fiscal year. This means goods and services worth Rs 2.25 trillion is likely to be produced in the economy in 2015-16.

Generally, a part of whatever is produced by the economy is consumed. So, whatever is left is referred to as domestic savings.

If the country’s savings rate is high, it automatically gets the leverage to invest the money back in productive sectors, which results in higher gross capital formation and gives impetus to economic growth.

Key macroeconomic indicators

Indicators

2013-14

2014-15

2015-16

GDP growth (%) (basic prices)

5.72

2.32

0.77

GDP (Rs in bn)

1,964.54

2,120.47

2,248.69

Per capita income (Rs)

72,413

77,079

80,921

Gross domestic saving (Rs in bn)

234.23

186.42

118.17

Gross national saving (Rs in bn)

898.48

930.62

965.71

Gross capital formation (Rs in bn)

808.76

822.30

763.56

Gross fixed capital formation (% of GDP)

23.52

27.75

25.01

Workers’ remittance (as % of GDP)

27.66

29.11

32.09

But Nepal’s gross domestic savings rate of 5.26 per cent indicates Nepalis are consuming 94.74 per cent of the goods and services produced in the country. In other words, of Rs 2.25 trillion of goods and services likely to be produced in Nepal in 2015-16, Rs 2.13 trillion is likely to be consumed and only Rs 118.17 billion will probably be saved.

“Nepal’s gross domestic savings is falling because of the country’s inability to enhance its productive capacity,” said CBS Director General Suman Raj Aryal. This implies the country’s capacity to produce goods and services has not improved in a satisfactory manner, yet consumption has not fallen either because of money that is being sent by Nepalis working abroad.

“So, unless we produce more goods and services in Nepal, gross domestic savings will continue to remain at a low level,” Aryal said.

One of the repercussions of low gross domestic savings is lower gross capital formation, which hits a country’s capacity to produce more goods and services. And this is what is likely to happen in Nepal in the current fiscal, as gross capital formation is predicted to decline by 7.14 per cent to Rs 763.56 billion.

This is not good news for a country, which is struggling to recover from a long spell of subpar economic growth. Worse, Nepal’s gross fixed capital formation (GFCF) is already the lowest among least developed countries (LDCs).

As per a report released by the Asian Development Bank last year, Nepal’s GFCF averaged 21.2 per cent in between 2004 and 2013, as against LDC average of 24 per cent, whereas GFCF of middle income nations stood at 29 per cent of the GDP during that period.

“The country’s gross fixed capital investment has to be raised to at least 30 per cent from existing level to support higher economic growth,” ADB report titled ‘Financing Asia’s Future Growth’ had said.

But GFCF is likely to stand at 25.01 per cent of the GDP in the current fiscal, as against 27.75 per cent in the last fiscal, show CBS data.

One of the reasons for low GFCF in Nepal is low allocation of budget for public capital spending. What is even worse is the government’s inability to fully utilise the allocated funds.

In the current fiscal year, for instance, the government allocated Rs 208.88 billion for capital expenditure, which was around nine per cent of the GDP. But so far only Rs 41.27 billion, or 19.76 per cent, of allocated budget has been spent.

This means Nepal will not be able to fully utilise its capital budget this fiscal as well, as less than three months remain for the fiscal year to end.

This calls for enhancement of fund absorptive capacity of government and overhaul of public financial management system.