Profit of banks jumps 29.7pc

The profit of commercial banks jumped by 29.7 per cent in the last fiscal year, signalling that over four-month-long supply disruption along Nepal-India border points that significantly reduced imports did not have any impact on class ‘A’ financial institutions in the country.

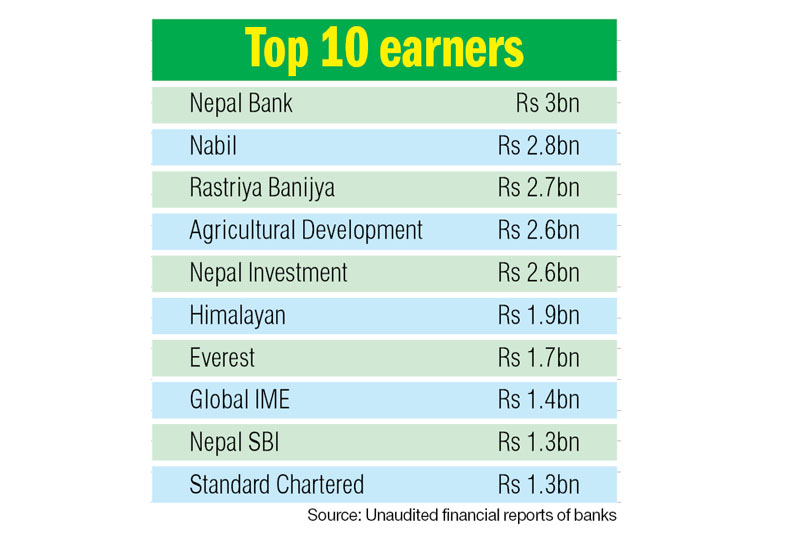

A total of 28 commercial banks operating in the country booked a net profit of Rs 36.7 billion in the one-year period through July 15, show the unaudited financial reports of banks published till today. Banks had generated a net profit of Rs 28.3 billion in the same period a year ago.

Of the banks operating in the country, 18 were able to generate net profit of over Rs one billion in the last fiscal year, as against nine in the same period a year ago.

The new entrants in the ‘billionaire club’ were Nepal Bank Ltd, Global IME Bank, Siddhartha Bank, Nepal Bangladesh Bank, NMB Bank, Prime Bank, Citizens Bank, NIC Asia Bank and Sanima Bank.

State-controlled Nepal Bank Ltd led the pack of highest profit earners in the last fiscal, with net profit of the institution standing at Rs three billion — up 524 per cent than in the same period a year ago.

The bank’s profit soared in the last fiscal as it generated a non-operating income of Rs 1.7 billion, which includes income from sale of shares and recovery of loans that were written off. The bank also reduced its cost of fund to 1.98 per cent from 2.33 per cent a year ago, which helped it post net interest income of Rs 4.7 billion. It also reduced its staff expenses by 10 per cent in the last fiscal year.

Next in league table of highest profit generators in last fiscal was Nabil Bank. The private sector-led commercial bank witnessed 34.76 per cent jump in its net profit to Rs 2.8 billion.

Close on the heels of Nabil was state-owned Rastriya Banijya Bank (RBB), which booked a net profit of Rs 2.7 billion. The bank’s profit, however, was 43 per cent lower than in the same period a year ago.

RBB’s profit fell as it had not witnessed organic growth in its income in fiscal 2014-15. In 2014-15, the bank’s profit had swelled to Rs 4.6 billion, as it had generated close to Rs three billion from sale of properties. Since it could not generate income from similar source in last fiscal, its profit fell.

Other banks that witnessed drop in profit in the last fiscal year were Agricultural Development Bank and Standard Chartered Bank.