Auto loan cap slams brake on four-wheelers’ growth

Kathmandu, August 3

The government’s decision to put a cap on the loan-to-value ratio of automobile loans in February this year slammed the brakes on market growth of four-wheelers in the country in fiscal year 2016-17.

As a direct impact of the central bank’s decision to restrict banks and financial institutions from extending auto loans of over 50 per cent of the value of vehicle to customers in a bid to curb the credit crunch situation, sales of four-wheeler vehicles dropped dramatically in the last fiscal year. The growth of four-wheeler market had been gathering speed every passing year since the previous five years.

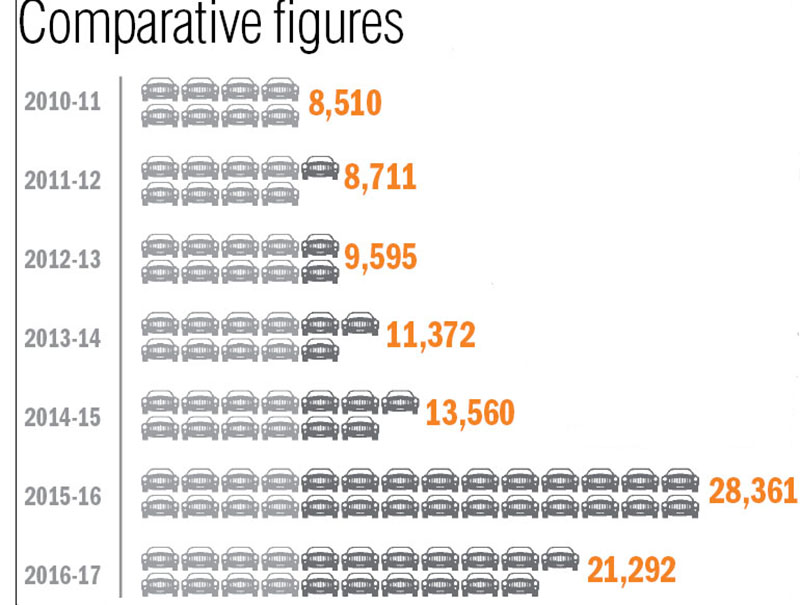

The statistics prepared by the Department of Transport Management (DoTM) show that 21,292 four-wheelers (car, jeep, van) were imported into the country in fiscal 2016-17. The number was a steep drop of 25 per cent compared to the previous fiscal 2015-16.

The four-wheeler market had been witnessing robust growth since fiscal 2011-12, when 8,711 four-wheelers had been imported into the country against 8,510 in the previous year. The import of four-wheelers increased to 9,595 in 2012-13, to 11,372 in 2013-14 and to 13,560 in 2014-15. The number of four-wheelers imported more than doubled in the subsequent fiscal of 2015-16 to reach a record high of 28,361.

While DoTM data show a slump of 25 per cent in four-wheeler import, automobile dealers claimed that their business decelerated by almost 60 per cent in the last fiscal as a result of the auto loan cap.

“The slowdown in four-wheeler import is actually nothing compared to the drop in sales of vehicles after Nepal Rastra Bank (NRB) imposed the auto loan cap,” claimed Saurabh Jyoti, former president of Nepal Automobile Dealers’ Association (NADA) — the umbrella organisation of domestic automobile dealers. According to him, automobile dealers have been facing a hard time clearing the stock of vehicles as a huge number of imported four-wheelers are gathering dust in the warehouses.

Opining that banks and financial institutions (BFIs) should be given the liberty to fix such cap on auto loans, auto dealers said such restrictions imposed by the central bank threaten to permanently impede the growth of the four-wheeler market.

More than 70 per cent of four-wheelers sold in the Nepali market are financed by BFIs.

Though the central bank recently revisited its earlier decision and raised the loan-to-value ratio on auto loans for private vehicles to 65 per cent from 50 per cent, auto dealers said that four-wheeler business is yet to pick up speed.

“Though the loan cap was revised through the monetary policy, BFIs have not implemented the new provision stating they are yet to receive a written notice in this regard from NRB,” added Jyoti.

The cap on auto loan seems to have had comparatively less effect on two-wheeler business. This is because more than 70 per cent of two-wheelers sold in the market are paid for upfront in cash.

DoTM data show that 354,071 two-wheelers were imported in Nepal in 2016-17 against 267,439 in 2015-16. Similarly, DoTM data show that altogether 444,259 vehicles were imported into the country in the last fiscal year, which has taken the total number of registered vehicles in Nepal so far to 2,783,428 units.