Internal wrangling weighs on investor sentiment

Kathmandu, December 16

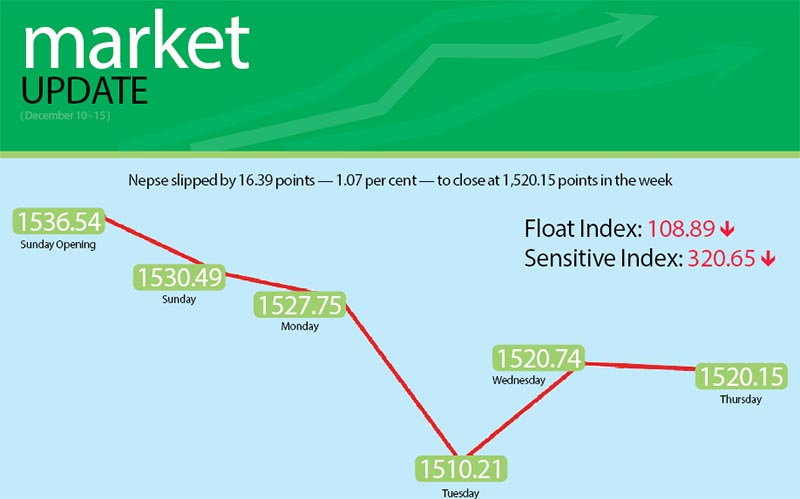

Share market investors seem unimpressed by the news of a stable government with strong majority being formed in the country after a long time as the Nepal Stock Exchange (Nepse) index recorded a loss of more than one per cent in the trading week between December 10 to 14.

Along with the Nepse index, the sensitive and the float indices also fell in the review period. The sensitive index dropped by 3.02 points or 0.93 per cent to 320.65 points and the float index fell by 1.53 points or 1.39 per cent to 108.89 points.

The benchmark index had opened at 1,536.54 points on Sunday and fell to 1,530.49 points by the time of closing for the day. The market continued the trend on Monday and decreased to 1,527.75 points. Similarly, the secondary market fell to 1,510.21 points on Tuesday. Meanwhile, the local bourse recovered some of the loss by rising to 1,520.74 points on Wednesday. However, it dipped again on Thursday to close at 1,520.15 points for the week.

Investors and stock market analysts pointed out that the market has been affected due to internal reasons rather than external issues like political affairs and others.

“The issue of value added tax (VAT) in share transaction was one of the prime reasons that affected the investors’ psyche, and the capital market plunged despite positive external environment,” a broker said, seeking anonymity.

The Taxpayers Service Office Tripureshwor had written a letter to three brokerage firms to pay their outstanding VAT, which drew immediate backlash from the brokerage companies.

Meanwhile, Nawaraj Subedi, chairman of Nepal Stock Market Investors Association, said the market volatility can also be attributed to some technical reasons rather than external factors, and that the trend may continue for the next few days.

“Though the central bank is saying there is sufficient liquidity in the market, banks and financial institutions are not being able to provide loans. Investor sentiment has also taken a hit as the interest rates have gradually started to rise,” Subedi said.

He further informed that with the real estate sector reviving, a number of investors have shifted their focus on purchasing property.

In the secondary market, the sub-index of commercial banks plunged by 13.22 points or one per cent to 1,295.78 points. Share price of Himalayan Bank dropped by 3.78 per cent to Rs 840 per unit and that of Century Commercial Bank fell by 1.82 per cent to Rs 216 per unit.

Along with commercial banks, sub-indices of other financial sectors — development banks, microfinance, insurance and finance — also plunged during the review period. The sub-index of development banks fell to 1,748.23 points, down 33.23 points or 1.86 per cent. Likewise, the microfinance group descended by 29.29 points or 1.56 per cent to 1,845.48 points. The sub-index of insurance fell to 7,894.84 points, dropping by 233.81 points or 2.88 per cent and the finance group shed 4.74 points or 0.62 per cent to 760.4 points.

Similarly, the sub-index of hotels descended by 59.26 points or 2.69 per cent to 2,146.25 points and hydropower group fell to 2,056.83 points, descending by 39.20 points or 1.87 per cent.

Meanwhile, the manufacturing sector ascended by 84.12 points or 3.45 per cent to 2,523.01 points. Similarly, the others group rose by 19.38 points or 2.19 per cent to 902.91 points in the week.

Trading was the only group to remain stationary at 205.24 points in the week.

Altogether, 5.8 million shares of 179 companies worth Rs 2.93 billion were traded through 23,727 transactions during the week. The traded amount was 61.54 per cent higher than the total weekly turnover of the previous week.

Standard Chartered Bank Nepal secured the top position in terms of total turnover with Rs 433.68 million. It was followed by Global IME Bank with Rs 159.32 million, Butwal Power Company with Rs 125.66 million, Nepal Telecom with Rs 125.1 million and Rastriya Beema Company (Promoter) with Rs 106.91 million.

Global IME Bank topped the list in terms of trading volume, with 482,000 of its shares changing hands and Standard Chartered Bank was the forerunner in terms of number of transactions — 3,616.

New listings

Company

Type

Unit

Alpine Development Bank

Rights

1,803,247

Himalayan General Insurance

Rights

6,420,000

Muktinath Bikas Bank

Rights

6,170,865.04

Neco Insurance

Bonus

712,895.99