Lending growth surges 20pc despite low deposit collection

Kathmandu, June 1

Commercial banks have mobilised a total of Rs 278 billion credit in the first 10-and-a-half months of the current fiscal 2016-17 against deposit collection (in local currency) of Rs 212 billion.

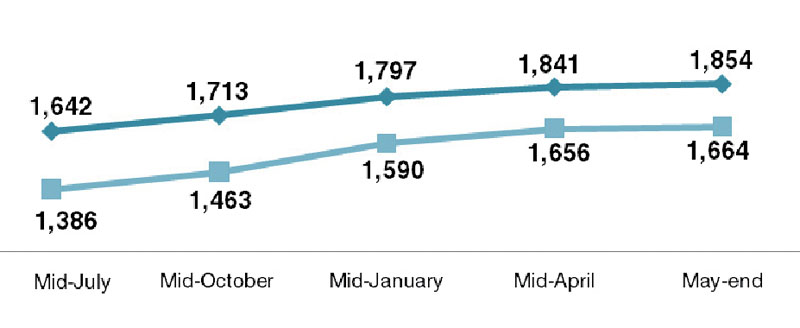

According to data unveiled by Nepal Bankers’ Association (NBA), deposit collection of commercial banks increased to Rs 1,854 billion from Rs 1,642 billion till May-end, while credit has risen significantly to Rs 1,664 billion from Rs 1,386 billion over the same period.

Credit growth has continuously outpaced deposit collection since the first quarter of this fiscal along with improved economic activities following the slowdown in the last two consecutive fiscal years due to the devastating earthquake and trade disruptions.

“Banks are struggling to fulfil the credit demand at present as they are bound to maintain 80 per cent credit to core capital cum deposit (CCD) ratio,” said Anal Raj Bhattarai, a former banker. “The current situation is the consequence of slow capital expenditure and the government should mobilise the idle funds through financial system if the government has treasury surplus of above 10 per cent of the budget.”

The government’s treasury surplus has ballooned to Rs 254 billion, while at the same time banks are running out of funds to issue loans. The government has spent only 52.46 per cent of the total allocated budget of Rs 1,048.92 billion in the review period, according to the Financial Comptroller General Office (FCGO). And only around 35 per cent of the allocated Rs 311.95 billion development budget had been spent till end of May.

Meanwhile, the deposit growth of commercial banks stood at 13 per cent in the review period whereas the credit growth exceeded 20 per cent. Slowdown in remittance growth, government’s slow capital expenditure and other lucrative avenues for investors (capital market, IPOs, FPOs) resulted in slow deposit collection.

Nepal Rastra Bank (NRB) has offered some respite to commercial banks in CCD calculation by allowing deduction of 50 per cent of their total exposure to the productive sector in CCD calculation at the end of this fiscal.

However, the central regulatory and monetary authority has asked the banks to do their level best in collecting deposits by utilising all the available means.

The CCD ratio is calculated by dividing loans disbursed in local currency by the sum of local currency deposit and core capital. This outcome is then multiplied by 100 and it should not exceed 80 per cent. As per the revised provision, banks can now deduct 50 per cent of the loan amount disbursed to the productive sector from the total disbursed loan. This provision has given some breathing room for banks to issue loans despite slow deposit collection.

Consequently, commercial banks expanded Rs 66 billion in credit in third quarter of the fiscal against deposit collection of Rs 44 billion in the same period, irrespective of the acute credit crunch seen in the second quarter.