Nepse index sheds 10.56 points

As the recently announced budget for fiscal year 2018-19 has increased the capital gains tax levied on share transactions, the Nepal Stock Exchange (Nepse) index shed 10.56 points or 0.80 per cent to rest at 1,307.66 points in the trading week between May 27 and 31.

“Though the capital gains tax has been raised, the budget for next fiscal has addressed many of the issues related to the share market,” said Ambika Prasad Poudel, chairman of Nepal Investors Forum. “For instance, the government has said that value added tax (VAT) will not be levied on share brokers’ commission.”

According to Poudel, it is a very good opportunity for long-term investors to buy shares. The capital gains tax has been increased from 25 per cent to 30 per cent, however, looking at the budget as a whole it has introduced policies that are share market-friendly.

Similarly, Prakash Rajhaure, an independent share market analyst, also said the budget for next fiscal is positive for the share market. “The government recently tightened the provision regarding ‘know your customer’ (KYC) for all investors. That’s why some people who previously used to invest their ill-gotten money in the share market are worried right now.”

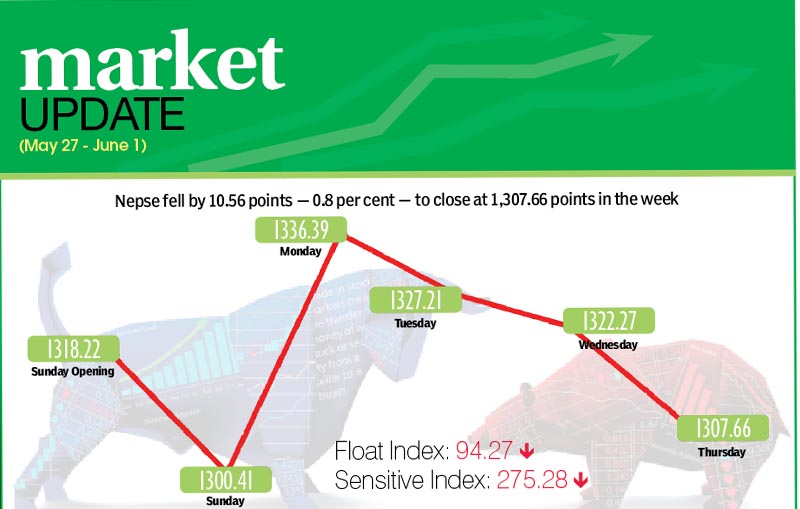

The market had opened at 1,318.22 points on Sunday. It shed 17.81 points to close at 1,300.41 points by the end of the trading day. However, the Nepse index witnessed a massive gain of 35.98 points to 1,336.39 points on Monday. But on Tuesday it dropped

by 9.18 points to 1,327.21 points and went down further by 4.94 points to 1,322.27 points on Wednesday. Continuing the downward trend, the local bourse slipped by 14.61 points on Thursday to close the week at 1,307.66 points.

Along with the Nepse index, the sensitive and float indices also fell in the review week. The sensitive index, which measures the performance of class ‘A’ stocks, declined by 2.61 points or 0.93 per cent to 275.28 points. Similarly, the float index that gauges the performance of shares actually traded also fell by 0.77 point or 0.81 per cent to 94.27 points.

In the review period, of the 10 subgroups in the share market, half of them landed in the green zone and the remaining five landed in the red zone. Trading, insurance, finance, microfinance and development banks subgroups recorded gains below one per cent, while

the remaining five subgroups witnessed losses in between 0.04 per cent and 1.61 per cent.

The trading sub-index inched up by 0.78 per cent or 1.60 points to 205.9 points. Likewise, insurance subgroup also went up by 0.75 per cent or 51.13 points to close the week at 6,839.03 points. Meanwhile, the finance sub-index also rose by 0.64 per cent or 4.14 points to land at 646.34 points.

Likewise, microfinance subgroup saw a gain of 0.14 per cent or 2.47 points to 1,757.07 points. Also, the development banks sub-index went up by 0.07 per cent or 1.20 points to close the week at 1,513.84 points.

On the other hand, hotels subgroup fell by 0.04 per cent or 0.82 point to rest at 1,965.87 points. Others subgroup dropped by 0.30 per cent or 2.25 points to land at 745.91 points. The manufacturing sub-index also slipped by 0.32 per cent or 7.58 points to 2,310.98 points, while hydropower shed 1.23 per cent or 20.10 points to 1,609.64 points.

Banking — the subgroup with the highest weightage in the share market — descended by 1.61 per cent or 18.14 points to 1,106.23 points.

Altogether, 4.74 million shares of 183 companies worth Rs 2.08 billion were traded through 23,548 transactions during the week. The traded amount was 8.56 per cent higher than the total weekly turnover of the previous week, which was recorded at Rs 1.92 billion. In the past week, 4.13 million shares of 183 companies had changed hands through 19,713 transactions.

In terms of weekly turnover, Nepal Bank was at the top with Rs 75.49 million. It was followed by Global IME Bank with Rs 72.74 million, Sana Kisan Bikash Bank with Rs 67.16 million, Premier Insurance with Rs 62.55 million and Prabhu Insurance with Rs 60.4 million.

In the review period, in terms of number of shares transacted, Citizens Bank International was the leader with 337,000 units of its shares changing hands and Premier Insurance had the highest number of transactions — 1,673.

NEW LISTINGS

Company

Type

Unit

Civil Bank

Rights

20,740,886.75

Everest Insurance

Bonus

121,500

NLG Insurance

Bonus

1,280,812

Nepal Life Insurance

Bonus

13,005,000.23

Sana Kisan Bikas Laghubitta Bittiya Sanstha

Bonus

1,257,655.85

Source: Nepse