Nepse retreats below 1,300-point threshold

The news about Nepal Bankers’ Association — the umbrella organisation of commercial banks in the country — suspending inter-bank transactions with NIC Asia Bank for breaching the gentlemen’s agreement to cap interest rate on deposits at eight per cent weighed heavily on the investor sentiment in the trading week between March 11 and 15.

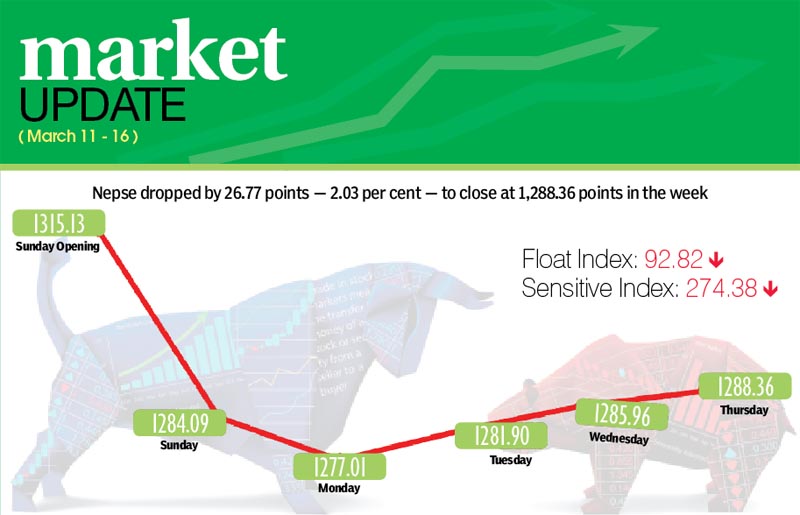

Consequently, the Nepal Stock Exchange (Nepse) index recorded a week-on-week drop of 26.77 points or 2.03 per cent to over a one-year low level.

Opening the week at 1,315.13 points on Sunday, the benchmark index had plunged by 31.04 points to retreat below the psychological level of 1,300 points. Nepse remained southbound on Monday as well, although the loss was limited to 7.08 points. Thereafter, the local bourse reversed course — rising by 4.89 points on Tuesday, 4.06 points on Wednesday and 2.40 points on Thursday to rest at 1,288.36 points for the week.

The last time Nepse had closed at the current level was back in February last year.

Sensitive index, which gauges the performance of class ‘A’ stocks, fell by 1.82 per cent or 5.08 points to 274.38 points. Similarly, the float index that measures the performance of shares actually traded also slipped by 1.98 per cent or 1.88 points to 92.82 points.

Trading was the only subgroup to hold steady at 208.43 points. Hotels was the sole subgroup to land inthe green and that too barely — inching up by 0.63 per cent or 12.04 points to 1,920.25 points.

Manufacturing led the pack of losers, with the sub-index taking a dive by 4.16 per cent or 96.60 points to 2,226.73 points.

Microfinance plunged by 3.8 per cent or 58.05 points to 1,468.75 points. Close on its heels, insurance subgroup retreated by 3.42 per cent or 221.58 points to 6,246.76 points.

Hydropower dropped by 2.82 per cent or 45.43 points to 1,566.69 points.

The three subgroups related to the financial sector fell by over one per cent — banking was down 1.77 per cent or 20.62 points to 1,143.15 points; finance was down 1.42 per cent or 9.58 points to 666.79 points and development banks was down 1.22 per cent or 18.69 points to 1,507.05 points.

Others managed to limit its loss to below one per cent — shedding 0.30 per cent or 2.12 points to settle at 712.77 points for the week.

The country’s only secondary market recorded 17,287 transactions of 3.34 million shares of 174 companies that amounted to Rs 1.29 billion in the trading week. Even as the market remained open for only four days against normal five in the preceding week, the traded amount back then was 27.92 per cent higher. Back then, 22,437 transactions of 4.79 million shares of 171 companies that totalled Rs 1.79 billion had been undertaken.

Nepal Life Insurance Co topped the chart in terms of number of transactions and weekly turnover, recording 869 transactions worth Rs 82.06 million. Nabil Bank with Rs 57.41 million, Everest Bank with Rs 55.44 million, Nepal Investment Bank with Rs 47.82 million and NIC Asia Bank with Rs 45.99 million rounded up the top five with highest weekly turnover in the review period.

With 167,000 of its shares changing hands, Janata Bank was the forerunner in terms of trading volume.

NEW LISTINGS

Company

Type

Units

Barun Hydropower

Bonus

121,500.00

Chilime Hydropower

Bonus

5,171,886.72

Excel Development Bank

Bonus

1,158,302.25

Global IME Laghubitta

Bittiya Sanstha

Bonus

113,000.00

Guheshwori Merchant

Banking and Finance

Bonus

1,091,249.31

Kailash Bikas Bank

Bonus

2,291,488.00

Laxmi Laghubitta

Bittiya Sanstha

Bonus

220,000.00

Mount Makalu

Development Bank

Rights

345,800.00

Prudential Insurance

Bonus

855,360.00

Swarojgar Laghubitta

Bittiya Sanstha

Bonus

174,996.80

Source: Nepse