Secondary market surges on positive cues

KATHMANDU, JULY 18

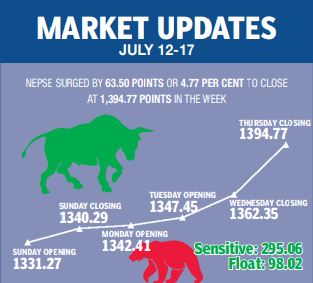

As the Ministry of Finance, Nepal Rastra Bank and Securities Board of Nepal have all hinted at introducing positive provisions to boost the secondary market, the Nepal Stock Exchange (Nepse) index ascended by 4.77 per cent or 63.50 points in the trading week between July 12 and 16.

“The market regulator and other government authorities had all given hints that the Monetary Policy for next fiscal that was launched on Friday by the central bank would bring secondary market-friendly policies. Hence, investors were already aware about the tentative provisions in the Monetary Policy,” said Chhotelal Rauniyar, chairperson of Nepal Investors Forum.

Rauniyar further said that there is a trend of the secondary market usually going up towards the end of each fiscal year, so that could be another reason why the Nepse index has seen a surge of late.

Along with the benchmark index, the sensitive index also went up by 5.19 per cent or 14.57 points to 295.06 points and float index increased by 5.28 per cent or 4.92 points to 98.02 points in the review week.

The weekly turnover also rose by 4.58 per cent as compared to the previous week to Rs 5.40 billion. In the previous week, the market had witnessed transactions worth Rs 5.16 billion. Similarly, trading volume ascended to 1.51 million stocks changing hands this week from 1.36 million in the previous week.

The secondary market had opened on Sunday at 1,331.27 points and went up by 9.02 points by the end of the trading day. It again rose by 2.12 points on Monday, 5.04 points on Tuesday, and by 14.90 points on Wednesday. The local bourse again surged by 32.42 points on Thursday to close the week at 1,394.77 points.

In the review week, only the hotels subgroup landed in the red zone. It dropped by 3.11 per cent or 47.60 points to land at 1,480 points.

Microfinance subgroup, which was the highest gainer of the week, expanded by 8.69 per cent or 195.62 points to 2,445.47 points, with the share price of Chhimek Laghubitta Bikas Bank rising by Rs 78 to Rs 1,097.

Similarly, banking ascended by 6.18 per cent or 69.51 points to 1,193.99 points as the share price of Himalayan Bank went up by Rs 42 to Rs 558.

Moreover, mutual funds surged by 5.64 per cent or 0.56 point to 10.48 points. Likewise, development banks sub-index rose by 3.76 per cent or 64.35 points to 1,771.48 points as the share value of Jyoti Bikas Bank edged up by five rupees to Rs 171.

Similarly, trading subgroup increased by 3.46 per cent or 29.73 points to 889.96 points with the share price of Salt Trading Corporation going up by Rs 160 to Rs 2,860. Finance went up by 2.81 per cent or 18.37 points to 671.53 points and non-life insurance gained 2.71 per cent or 166.98 points to 6,324.56 points.

Meanwhile, life insurance subgroup inclined by 2.63 per cent or 211.11 points to 8,218.49 points.

Others sub-index expanded by 2.56 per cent or 19.40 points to 775.32 points and hydropower was up by 1.98 per cent or 19.04 points to 976.10 points. Likewise, manufacturing subgroup inched by 0.99 per cent or 27.13 points to 2,747.24 points.

In the review week, Nepal Reinsurance Company was the leader in terms of trading volume, number of transactions and weekly turnover, with 1.078 million of its shares traded through 17,537 transactions that amounted to Rs 548.81 million.

Nepal Life Insurance Co with Rs 400.47 million, NIC Asia Bank with Rs 300.52 million, NMB Bank with Rs 298.98 million and Himalayan Distillery with Rs 182.58 million rounded up the top five companies in terms of highest weekly turnover.

With 758,000 of its shares traded in review week NMB Bank ranked second in the given category. It was followed by NIC Asia Bank with 559,000, Global IME Bank with 489,000 and Nepal Bank with 352,000 shares.

Meanwhile, Nepal Life Insurance Co with 2,508, NMB Bank with 2,459, NIC Asia Bank with 1,999 and Global IME Bank with 1,765 transactions were the other listed companies to witness high transactions.

A version of this article appears in e-paper on July 19, 2020, of The Himalayan Times.