Selling pressure weighs on domestic bourse

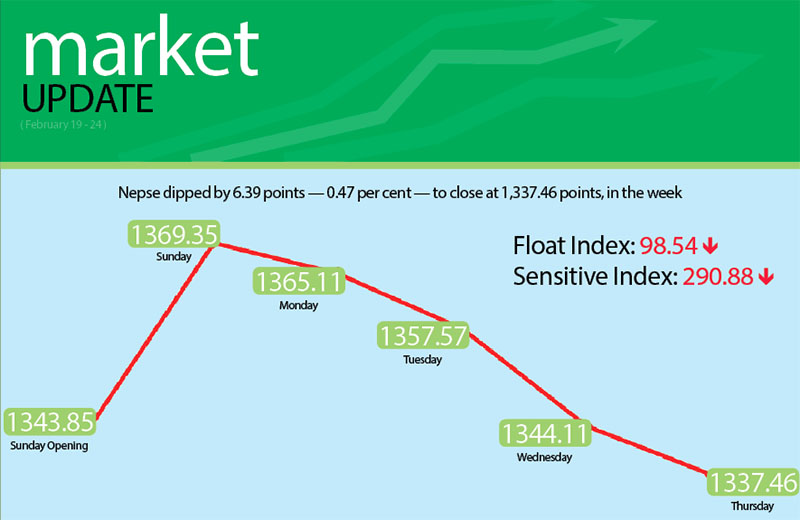

Starting the week on a buoyant note, the selling pressure proved to be a drag in the domestic share market in the week of February 19 to 23, with the Nepal Stock Exchange (Nepse) index shedding 6.39 points or 0.47 per cent week-on-week.

Opening at 1,343.85 points on Sunday, the benchmark index had surged by 25.5 points by the day’s closing. However, the local bourse reversed course thereafter owing to profit-booking by short-term investors and political uncertainty around the local polls. Nepse index shed 4.24 points on Monday, fell by 7.54 points on Tuesday, dropped by 13.46 points on Wednesday and retreated by 6.65 points on Thursday to close at 1,337.46 points for the week.

Altogether, 6.23 million shares of 161 companies worth Rs 2.75 billion were traded through 28,068 transactions in the week. The traded amount was 6.43 per cent higher than the preceding week when 29,327 transactions of 7.90 million shares of 155 firms worth Rs 2.58 billion had been undertaken.

The sensitive index, which gauges the performance of class ‘A’ stocks, fell by 1.64 points or 0.56 per cent to 290.88 points. Likewise, the float index that measures the performance of shares actually traded also dipped by 0.78 point or 0.78 per cent to 98.54 points in the review period.

Whereas trading remained steady at 206.16 points, half of the remaining subgroups witnessed gains while the other half recorded losses.

Others led the pack of gainers, with the sub-index up 15.04 points or 2.2 per cent to 699.91 points. This was on the back of share value of Nepal Telecom going up by 2.73 per cent to Rs 678.

Development banks rose by 15.94 points or 1.11 per cent to 1,447.4 points. Swabhalamban gained 3.21 per cent to Rs 1,156 and Kagbeli surged by 10.65 per cent to Rs 540, among others.

Adding to the previous week’s surge of 7.97 per cent, insurance subgroup edged up by 45.49 points or 0.78 per cent to 5,855.35 points. Meanwhile, finance barely managed to land in the green zone as the subgroup inched up by 0.02 point to 615.78 points.

Hotels shed some of the gains of the past week as the subgroup lost 30.52 points or 1.76 per cent to land at 1,705.81 points. Even as Taragaon Regency increased by 3.53 per cent to Rs 205 and Oriental inched up 0.21 per cent to Rs 475, the sub-index dropped because Soaltee was down 2.83 per cent to Rs 275.

It was the drop of 19.13 points or 1.48 per cent to 1,273.45 points by the banking subgroup that was the deadweight for the benchmark index. This is because commercial banks have highest stake in country’s sole secondary market. Himalayan shed 1.85 per cent to Rs 849 and NIC Asia descended 5.38 per cent to Rs 422, among others.

Hydropower and manufacturing subgroups managed to limit their losses below one per cent. Hydropower sub-index dipped by 14.7 points or 0.93 per cent to 1,558.39 points, whereas manufacturing edged down 5.98 points or 0.28 per cent to 2,139.22 points.

Meanwhile, Bank of Kathmandu secured top position in terms of weekly transaction and turnover — 1,529 transactions and Rs 148.86 million. The other listed companies to make it to the list of top five in terms of traded amount were Nepal Life Insurance Co with Rs 106.45 million, Prabhu Bank with Rs 93.91 million, Shikhar Insurance Co with Rs 87.21 million and Nabil Bank (Promoter Share) with Rs 74.55 million.

NIBL Samriddhi Fund – I was the forerunner in terms of trading volume with 384,000 of its scrips changing hands.