Selling pressure weighs on share market

KATHMANDU, DECEMBER 12

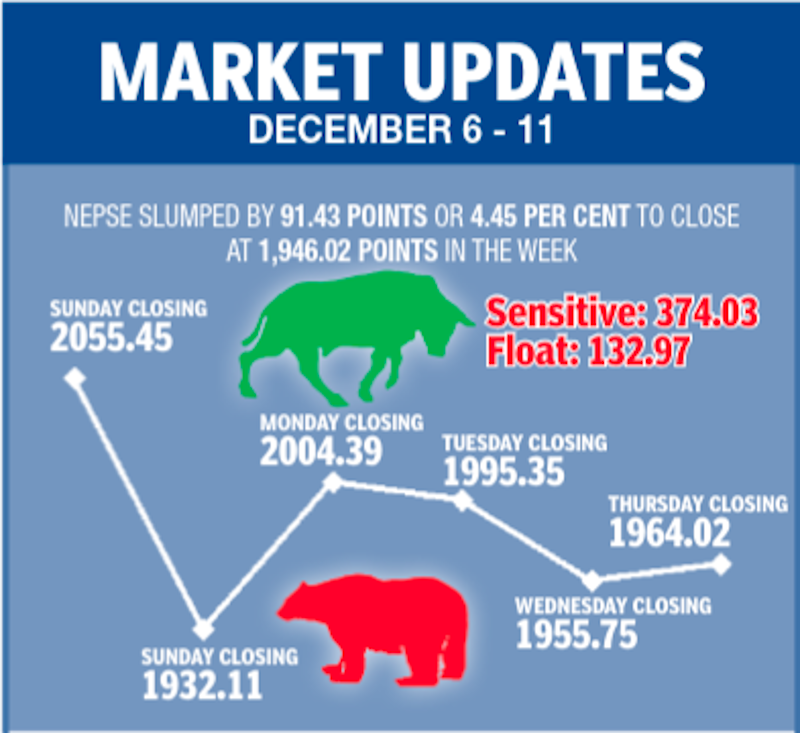

Profit-booking by short-term investors weighed on the country’s sole secondary market, with the Nepal Stock Exchange (Nepse) index plunging by 4.45 per cent or 91.43 points week-on-week in the trading period between December 6 and 10.

Starting the week at 2,055.45 points, the massive selling pressure resulted in the benchmark index plunging by 123.34 points or the daily limit of six per cent by 2:13pm, prompting the market regulator to suspend the trading for the day.

The last time trading had been suspended due to market movement of six per cent was back in July 19, when Nepse index had surged by six per cent.

On Monday, the benchmark index recovered some of the earlier day’s loss, rebounding by 72.28 points to close above 2,000 points again. The share market saw some of that gain wiped out over the next two days, however, with the index dropping by 9.04 points on Tuesday and falling by 39.60 points on Wednesday.

The secondary market ended the week on a positive note, with Nepse index inching up by 8.27 points to rest at 1,964.02 points.

“A correction was overdue because the market had started becoming over-heated,” said a share market analyst, adding the loss witnessed in the review period does not necessarily mean that the bull run has ended. “As the coronavirus pandemic hasn’t ended yet, I believe investors will continue to pour their funds in the share market in lack of other investment avenues.”

Nevertheless, the trading volume, number of transactions and weekly turnover in the review period fell significantly compared to the previous trading week.

A total of 37.29 million shares exchanged hands in the review week against trading volume of 101.17 million shares in the past week. Altogether 256,599 transactions were made, 28.17 per cent lower than preceding week’s 357,255 transactions. The weekly turnover plummeted by 56.03 per cent to Rs 18.02 billion from Rs 40.99 billion of the past week.

The sensitive index, which measures the performance of class ‘A’ stocks, fell by 4.65 per cent or 18.26 points to 374.03 points. The float index that gauges the performance of shares actually traded also dropped by 3.93 per cent or 5.44 points to 132.97 points.

Among the subgroups, hydropower was the only sub-index to land in the green.

The subgroup jumped 2.44 per cent or 42.30 points to 1,773.97 points.

Similar to previous week, trading landed at bottom of the pile, plunging by 8.19 per cent or 176.27 points to 1,975.05 points. It was, however, life insurance that witnessed the most number of points lost, with the sub-index down 4.18 per cent or 526.82 points to 12,079.87 points.

Nepal Reinsurance Co Ltd was the forerunner in all three categories — trading volume, number of transactions and weekly turnover, with 1.63 million of its shares traded worth Rs 2.57 billion through 16,989 transactions.