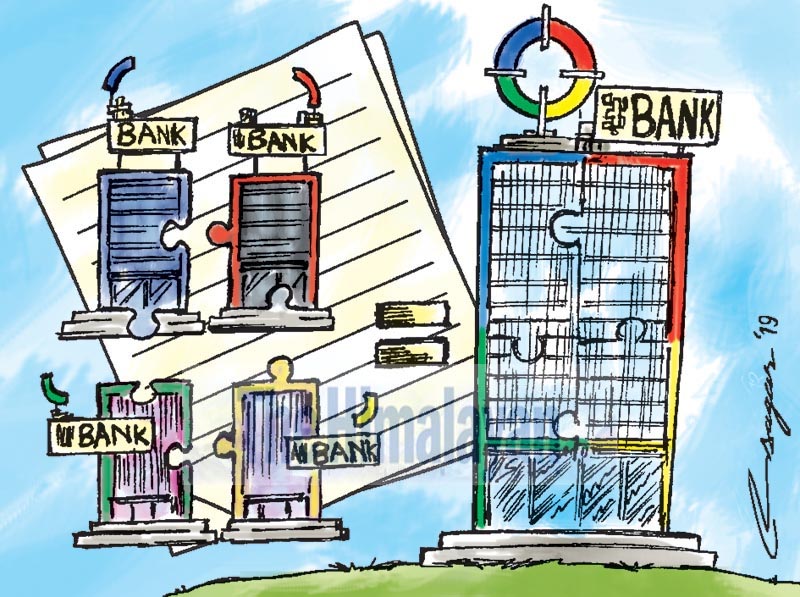

Seven banks submit M&A progress to NRB

Kathmandu, October 16

Seven commercial banks have submitted the progress of their merger and acquisition (M&A) process to the Nepal Rastra Bank (NRB) so far.

In line with the policy adopted by the central bank to encourage banks and financial institutions towards merger, Sanima Bank, Nabil Bank, Janata Bank, Laxmi Bank, Everest Bank, Prime Bank and NMB Bank have submitted the progress they have made towards merger with other banks, as per NRB Spokesperson Laxmi Prapanna Niraula.

While a total of 22 banks had expressed their commitment to go for M&A process with NRB a few months ago, the central bank had sought progress details with these banks after they were found to be dilly-dallying in actuallygoing for merger.

Though Global IME Bank has not submitted its progress details, it has already informed NRB that the bank has principally agreed to go for merger.

“Majority of banks have informed NRB that they are searching for partners by forming technical committees. We expect that these banks will soon enter into the M&A process,” informed Niraula. As per him, progress details were sought from banks to know whether or not banks have started the M&A process in reality.

Meanwhile, bankers have been urging the government to reduce income tax levied on banks by at least five percentage points for a period of five years for those banks who choose to merge with others.

Through the budget for 2019-20 fiscal year, the government had encouraged banks and financial institutions (BFIs) to opt for merger and acquisition and announced a number of incentives for such banks through the Monetary Policy for ongoing fiscal year, including extension of the deadline for such banks to float required loans in agriculture, energy and tourism sectors till mid-July 2021.

Through the Monetary Policy, NRB had stated that merged banks will not have to take its approval to expand their branches across the country. Similarly, the cooling period of six months for board of directors of merged banks and their chief executive officer and deputy CEOs will not be applied, as per the Monetary Policy.