Share investors following rumours hardest hit

KATHMANDU, AUGUST 8

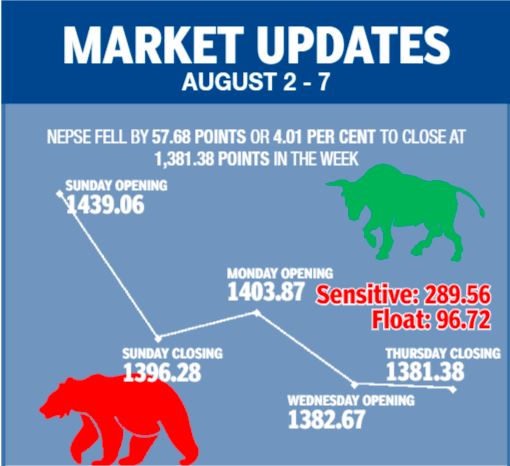

Most small investors in the country pour in money in the stock market without any technical or theoretical analysis. Thus, the secondary market’s movement is mostly defined by the rumours prevailing among share investors. After rising for a couple of weeks, the Nepse Stock Exchange (Nepse) index has gone on a correction mode and in the review week between August 2 and 6 it again dropped by 4.08 per cent or 57.68 points to 1,381.38 points.

As per secondary market analysts, investors who had started purchasing shares assuming that the market would go on a bull run for the foreseeable future are the worst hit now.

“Leaders of various investor associations start making claims that the market has improved when it begins to rise but as soon as there is a downturn they start blaming the regulator and the government,” stated Prakash Rajhaure, an independent stock market analyst.

“People started making analyses that the market would further improve as the interest rates of banks had decreased and Nepal Rastra Bank had allowed an increase in loans for share purchase without realising that the risk of the coronavirus was rising each day,” said Rajhaure, adding investors were very hopeful of a prolonged bull run even as global stock markets continued to tumble.

“These superficial analyses rather than technical study of the market has led to some investors to bear losses,” he said.

According to Rajhaure, many people entered the market assuming that they could earn from the stock market when other areas of business were comparatively down. “People who invest based on rumours are always the ones to take the hardest blow.”

In the review week, along with Nepse the sensitive index also descended by 3.79 per cent or 11.40 points to 289.55 points and float index dropped by 4.23 per cent or 4.27 points to 96.72 points.

The weekly turnover also declined by 34.1 per cent as compared to the previous week to Rs 5.27 billion. In the previous week, the market had witnessed transactions worth Rs 8.02 billion. Similarly, trading volume fell to 1.57 million stocks changing hands this week from 1.92 million in the previous week.

The secondary market had opened on Sunday at 1,439.06 points and sharply dropped by 42.78 points by the end of the first trading day. The market rebounded by 7.59 points the next day. The market remained closed on Tuesday due to a public holiday in the valley to celebrate the Gaijatra festival. When the market opened on Wednesday it again dropped by 21.20 points. The local bourse again decreased by 1.29 points on Thursday to close the week at 1,381.38 points.

In the review week, all the subgroups landed in the red zone.

The banking subgroup was the biggest loser of the week, falling by 4.73 per cent or 58.62 points to 1,179.91 points as the share price of Nabil Bank went down by Rs 37 to Rs 814 and Nepal Investment Bank’s share price dropped by Rs 24 to Rs 441.

Similarly, hotels descended by 4.12 per cent or 65.61 points to 1,523.94 points as the share price of Soaltee Hotel fell by five rupees to Rs 159.

Likewise, non-life insurance shrunk by 4.10 per cent or 269.73 points to 6,306.78 points as stock price of Himalayan General Insurance went down by Rs 13 to Rs 403.

Meanwhile, microfinance plummeted by 4.09 per cent or 100.26 points to 2,347.75 points as share price of Chhimek Laghubitta Bikas Bank dropped by Rs 65 to Rs 1,035.

Similarly, life insurance subgroup tumbled by 3.91 per cent or 336.89 points to 8,279.74 points and development banks fell by 3.79 per cent or 68.42 points to 1,738.61 points.

Moreover, manufacturing dropped by 3.25 per cent or 90.39 points to 2,692.67 points. The finance sub-index went down by 2.61 per cent or 17.57 points to 654.29 points and hydropower descended by 2.58 per cent or 25.07 points to 943.83 points.

Similarly, trading subgroup went down by 2.17 per cent or 18.48 points to 832.05 points. Likewise, mutual funds sub-index fell by 1.93 per cent or 0.21 point to 10.4 points and others subgroup inched down by 1.93 per cent or 15.65 points to 794.89 points.

In the review week, Nepal Reinsurance Company was the leader in terms of weekly turnover with Rs 581.17 million. It was followed by Nepal Life Insurance Co with Rs 394.14 million, Prabhu Bank (Promoter Share) with Rs 342.96 million, NMB Bank with Rs 237.67 million and NIC Asia Bank with Rs 210.32 million.

In terms of weekly trading volume, Nepal Reinsurance Company again was the forerunner with 995,000 of its shares changing hands. It was followed by NMB Bank with 573,000, NIC Asia Bank with 381,000, Nepal Bank with 363,000 and Global IME Bank with 354,000 shares being traded.

Meanwhile, Nepal Reinsurance Company topped in terms of number of transactions with 10,772 transactions.

It was followed by NIC Asia Laghubitta Bittiya Sanstha with 8,817, Ajod Insurance with 3,258, NMB Bank with 2,673 and Nepal Life Insurance Co with 2,458 transactions.

A version of this article appears in e-paper on August 9, 2020, of The Himalayan Times.