Share market still in correction phase

Kathmandu, November 16

As the government has been unable to address some of the major the concerns raised by share investors, the Nepal Stock Exchange (Nepse) has remained in correction phase.

According to share investors and analysts, the market sentiment has taken a beating following the announcement that the government was going to probe income source of large investors and cracking down on tax defaulters.

Prakash Rajhaure, an independent share market analyst, said that even though the Ministry of Finance has addressed the major concerns raised by investors, its line agencies are not playing a key role in resolving the issues through dialogue.

As per Rajhaure, investors were primarily concerned with the dispute related to the calculation method of capital gains tax (CGT), which has now been addressed. However, they still lack the confidence to make bulk transactions as the requirement to disclose income source for such transactions is still in place.

“The investors are waiting for policy clarity,” he said.

According to him, the share market is relatively stable, but is unlikely to rebound before January.

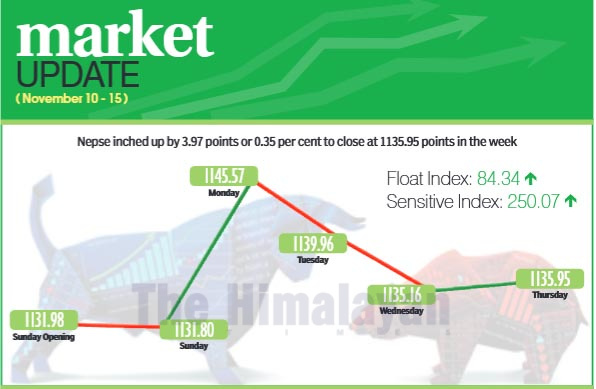

Nepse index saw some fluctuations in the trading week between November 10 and 14, but managed to record a slight gain of 0.35 per cent or 3.97 points. Sensitive index went up by 0.71 per cent or 1.75 points to 250.07 points. The float index was also up 0.46 per cent or 0.39 points to 84.34 points.

The weekly turnover surged by 40.13 per cent compared to the previous week to Rs 1.73 billion. In the previous week, the market had witnessed transactions worth Rs 1.23 billion. The trading volume also increased with 5.82 million stocks changing hands in the review period from 4.65 million in the previous week.

The benchmark index had opened at 1,131.98 points on Sunday and had shed 0.18 points by the end of the first trading day. The market jumped by 13.77 points on Monday. However, it reversed course and fell by 5.61 points on Tuesday and 4.80 points on Wednesday. The local bourse inched up by 0.79 points on Thursday to close the week at 1,135.95 points.

In the review week, trading, manufacturing, microfinance, finance, others, non-life insurance, banking and life insurance sub indices recorded gains.

The trading subgroup led the pack of gainers, climbing by 11.97 per cent or 39.07 points to 365.46 points. This was due to the share price of Salt Trading Corporation going up by Rs 148 to Rs 943.

The manufacturing sub-index went up by 2.31 per cent or 55.23 points to 2,450.97 points on the back of share value of Bottlers Nepal (Tarai) rising by Rs 125 to Rs 6,375.

Microfinance subgroup rose by 0.89 per cent or 13.18 points to 1,492.74 points. Similarly, finance sub-index ascended by 0.75 per cent or 4.21 points to 565.23 points and others subgroup went up by 0.60 per cent or 3.83 points to 634.43 points.

The non-life insurance rose by 0.43 per cent or 18.09 points to 4,158.85 points. Banking sub-index climbed by 0.27 per cent or 2.85 points to 1,042.04 points and life insurance inched up by 0.15 per cent or 7.35 points to 5,015.19 points.

At the other end of the spectrum, mutual funds lost 0.95 per cent or 0.09 points to 9.31 points. Hydropower sub-group went down by 0.56 per cent or 5.36 points to 944.36 points. Likewise, the development banks sub-index descended by 0.39 per cent or 6.09 points to 1,544.46 points and hotels subgroup fell by 0.39 per cent or 6.92 points to 1,775.48 points.

In the review week, NMB Bank topped the chart in all three categories — trading volume, transactions and weekly turnover — with 894,000 of its shares changing hands through 3,080 transactions that amounted to Rs 335.47 million.

Prabhu Bank with Rs 121.93 million, Himalayan Distillery with Rs 97.78 million, Nepal Bank with Rs 76.33 million and Machhapuchchhre Bank with Rs 73.20 million rounded up the top five firms making highest turnover in the review week.

In terms of trading volume, Prabhu Bank with 474,000 shares, Machhapuchchhre Bank with 325,000 shares, Nepal Bank with 250,000 shares and NCC Bank with 158,000 shares were the other top companies.

Meanwhile, the other top companies to record high number of transactions were Rashuwagadhi Hydropower with 1,487, Sanjen Jalavidhyut with 1,268, Prabhu Bank with 1,239 and Sabaiko Laghubitta Bittiya Sanstha with 1,000 transactions.