A penny saved is a penny earned

The practice of saving is important to ensure a secure future which is full of uncertainties

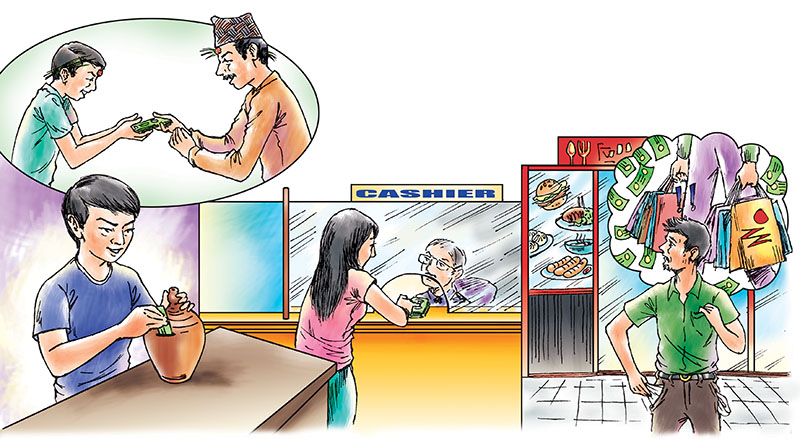

I’ve grown up in an environment where the saying ‘save now or regret later’ is the major motto of people around me. With life comes uncertainties. The biggest blessing as well as curse given to human beings is that they are unaware of what the future holds for them. However, prevention is better than cure, and it is important that we take certain decisions in the present which help us later during difficult times of our lives. Among these decisions, one of them is savings. Savings is not only a healthy habit but it also a form of securing one’s future. It’s a shame that I haven’t been able to earn a single penny until now but yet in order to develop the habit of saving, I always have a piggy bank with me. Every month when I am given my pocket money, I make sure that some portion of that money is dropped in my piggy bank. As I have always been a financially reliant person until now, I’ve never come across a situation where I had to use money from my piggy bank. So until now the money I have collected in my piggy bank goes into a donation box. This has not only taught me how to save but has also instilled in me the knowledge of how valuable money is.

— Mahima Poddar

I use piggy bank to save the little amount of my earnings. When I get my salary, I regularly put Rs 500 in the piggy bank, and then from the remaining I make plan or manage my expenditure. I break the piggy bank during times of emergency. When I was in Class IX, my mother bought a piggy bank for me during Dashain to start my habit of saving so that I didn’t spend money on unnecessary things. I used to put the half of my lunch allowance given by my mother or relatives during various occasion like puja. When I reached Class XI, I broke the piggy bank and bought a bicycle which I am using at present. This reminds me to save for the future also.

— Bibas Jung Thapa, Hetaunda

Saving money is a must for safe future. But if we don’t earn much, then it’s a tough job practically. The main trick for saving money is planned expenses. If we have more expenses than our income, it means serious planning is required which can be done by collecting all the bills of your expenses at the end of the month and then segregating them under headings or sectors like entertainment, apparels, stationery, hotels et cetera and just check where our money is going more and then control the expenses in that sector. If we know where our money is going, it will be easier to make changes that we need to. The most important thing for saving is to avoid using credit to pay our bills. Although it may make things easier now, but using credit increases our monthly payments in the future.

Saving doesn’t mean to save a lot at a time. Instead saving little for long periods comes with fruitful results. Everybody can save according to their income or pocket money like students, housewives and businessman. Saving was useful for me even during my student life to pay hospital bills when my friend got into an accident. So save for safe future.

— Raju Atal, Biratnagar

It is often argued that the nature of earning much money and barely paying bills are common in many people but when it comes to savings few people are seen being practical even when they know how significant savings are. Thus, saving money is more beneficial as it gives protection during emergencies and grows our wealth more and fast.

First of all, different people have different tricks to save money. When it comes to me I use piggy bank to save my money. It has been useful for me in critical points of life. The money that I saved was useful to pay my educational expenses when my family was facing financial burden. Similarly, saving money grows our wealth more and fast. For instance, Mark Zuckerberg is the burning example of it. His wedding reception was held in their backyard in Palo Alto, California rather than fancy five star hotel. It shows saving money grows wealth.

Secondly, I believe that saving money gives protection. The best and worst things about life is that it’s unpredictable, right? We never know what catastrophic events are about to befall us, so it’s better to save money for the future which provides protection for unexpected emergency. For instance, we even don’t know what will happen to us in the next days or weeks. Even if we lose our job, become disabled or can no longer work still we can survive while looking for a job because we have our saving. That’s why it’s more important to save money for future as it provides protection in times of emergency.

— Saroj Shrestha

Money is a difficult thing to earn and spending is not the correct way to utilise it. Spending it in the proper places and saving 10 per cent of the total salary is a smart way to work with your money.

I am an eighth grader — I do not have any source of income. During some special functions or gatherings such as Dashain, I get money and I save that in my piggy bank. As the money increases to Rs 10,000, I will deposit it in a bank in my account, and get interest per year. And I can use this money whenever I need. There have been many exceptional cases in my life when those savings have come handy. So I conclude, saving is the best way to utilise money.

— Tulip Gyawali, Minbhawan, Kathmandu

Saving has never been easy for me. I always make a strategy to lower my expenses by not making unnecessary expenses on initial pay days but by the end of the month I see my account is almost nil. We are all urged to save for our future but apparently what happens is the opposite. Not having to pay bills (beside food bills), yet no saving since the last two years is the saddest part. I can relate myself to all saving troll that are published in social media.

Everyone should practice saving because at a point of time it will definitely help. Saving is possible once we limit our expenses and make sure the expenses are genuine (conditions apply).

— Shradha Neupane, Boudha Mahankal

Saving money is one of the toughest things for me to follow as money doesn’t last longer in my hands. Once, I was engaged in a job for two months, without letting the cat out of my bag about it to anyone including my parents who were in India then. The money which I earned within the tenure of two months was blown away within one week in little things like catching-ups et cetera. My actual plan was to surprise my parents by gifting them something worthwhile. Unfortunately I ended up giving them only sweets on their arrival but it indeed was a proud moment for me as that was my first job which still remains mystery to them.

— Suresh Basnet

Success in life depends upon the fact how well we can manage our money. Unless the hard earned money is well saved and invested in legitimate, certified and well protected financial organisation we stand the chance of losing it partly or completely that can have severe impacts in our life. I personally do not believe in gimmicks, Ponzi schemes and big share market investments that can completely destroy the financial credibility of an individual. Hence, it is important to be judicious with the use for the hard earned money through appropriate channels like government certified financial schemes, investments in banks and post offices or in government or private organisations that have long standing market reputation.

My safe investment schemes have helped in the way that they never made me fabulously rich; but I had never had to deal with financial crisis at times when money was essential for revamping my life. A serious accident few years back, restrained me to the four walls of my apartment for three long years following multiple surgery and expensive rehabilitation. However, the well saved money in the bank helped me to survive the ordeal and put me back once again in normal life course, once I revived from the accident. People who dream of making big money by buying lottery or playing in casino or investing in dubious Ponzi schemes are to be blamed for their lust for money without putting the hard work to earn it with every bit of blood and sweat.

— Saikat Kumar Basu

When it comes to me, I really don’t have any specific purpose of saving money into my bank account. Anyway what I think is saving our money as a deposit in a bank will be helpful for the purpose of spending it on any important commodity for us. Besides we also save our money in order to spend for our family in needful times which saving is supposed to do. Well I have been saving my money in the most secured manner because I have to make sure that I have to spend it for my needs in near future. Money is something which matters in our life for the fact that the world has become commercial at the moment. Hence to me saving money is a matter of big deal.

— Pratik Shrestha, Buddhanagar, Baneshwor

A penny saved is a penny earned, as the thrifty Britishers used to say. I opine that most people who are trapped in poverty and cash crunch are either lazy or a spendthrift. Saving money is an art in itself. It requires patience and self control. Being able to say ‘No’ to things you love takes some courage. Let’s start by abstaining from buying unnecessary merchandise which only clutters our room. I have realised how obsessive one gets when shopping. We often end up over buying useless things resulting in guilt later. All because we can’t say ‘No’! So let’s overpower and defeat our egoistic obsessive desires for materialism. Let’s live a pure and simple life. We will never face financial hardships in that way.

— Nerinav

This questions reminds me of ‘that’ day when I had to face the toughest situation which I would like to share here. I used to fulfil my desire or whatever I needed without thinking of my true goal. But suddenly that day came when I didn’t have a penny in my pocket and I didn’t eat anything for two days because of that. That day changed my perception of spending money and I started saving money.

We should fulfil our needs but we shouldn’t spend on anything. If we don’t realise this, we have a problem. So we should take a right decision at right time because time and money waits for none.

— Krishna Sarraf, Dharan -18

We all are aware of the fact how important money is to lead a happy life in this materialistic world. But at times we tend to forget this and start spending as much as we like, more into those things which are least important than the important ones affecting us badly when we run out of money later in life. But money saved is money gained. These days the world has developed and prospered a lot. It’s easy for one to save money by depositing it into banks. I have witnessed people in general having the concept of ‘more you earn the more you can spend’ and it is absolutely wrong. Every day is not the same day, who knows what happens in future. Habit of saving money and valuing it is a must thing to do in life.

As far as I am concerned I definitely save money. Since I was young, I have had a habit of saving money in my piggy bank. So giving continuity to it I have followed that habit in recent times too. Not only this I also make sure in keeping all the coins in one box which we get after shopping which can be used later in some fruitful thing. I also believe in choosing the right place to shop, bargaining when needed and spending less or say only in the necessary things. These are also part of money saving and so I follow these too. At times I try to control myself to spend frivolously no matter how much money I have or how much I can spend which has also been very helpful for me to use that particular money which I didn’t spend earlier to spend in some productive things later.

— Tejaswi Pahari, Jawalakhel

Having gone through the depth of the question I have realised that saving money is not a big deal, but implementing is. We actually are told to think about the present but it doesn’t make sense in terms of saving money. We must have a habit of saving money so that it can be helpful in coming days. According to me saving should be included in daily habits. There are lots of things that are improved through this practice of saving and so that it can have a better advantage to us in future. Winners don’t do different things they do things differently, so we must have a different approach on saving money.

— Ujjwal Parajuli, Dharan 18

I like the idea of saving money. But the more we earn the more we spend. If I will have lots of money I will utilise it in necessary things and the remaining money will go to my savings. It’s better to deposit in a bank. Furthermore I want to invest the money in some project from which I can be benefited.

— Subha

Being frugal does not mean that you are economically poor or struggling, and yet if you are struggling economically then being frugal is the way to go. One of the important advices is not to worry about what the society will say if you do not do what others are doing, like spending extravagantly during Dashain, Tihar, wedding ceremony, et cetera. You can be happy and content with little, but it is impossible to be so with abundant wishes and desire to please others. Keep a record of your weekly expenses, including groceries, bills, et cetera. Avoid any impulse buying. Have a good idea of what you plan on buying when you go for shopping. At the end of a week, go through the recorded expenses and see if you can take few things off from the list. Make this a habit and pretty soon you will be living lightly, freely, and also happily.

— Ramas

Savings are, indeed, very important, but people rarely have this habit. Savings help us in critical moments of our life. These days people don’t save much for future because we spend a lot on having luxurious life than stable one. In the name of fashion and showing off people buy lots of clothes, usually more than enough, and eats out a lot. Having said that, eating out is not bad, but frequent eating is not plausible. It may seem little at that time but if we save them then that can be fortune. I myself used to waste a lot of money on eating at restaurants and cafés but I’ve been busy in college and studies for a while so I don’t have much time for those and I realised I’ve saved a lot and I mean it. There is no trick to save money but self control and determination. Start by refusing wasting money on unnecessary things which isn’t actually needed.

— Pema Wangmo

Do I use any trick to save money? Not really. But I always keep the maxim ‘cut your coat according to your size’ at the back of my mind. If all of us learn not to live beyond our means, we will all be happy and gay. Saving is not as easy as it sounds though. There are times when my heart wins over my head and I impulsively end up burning all my savings in a bar or while travelling or on my crushes. However, I manage to pick myself fast enough and end up saving again. Money is terribly important and the lack of it can mean life and death during extreme situations. We should, therefore, cultivate the habit of saving for the rainy days which in a poor country like Nepal can come without a pause like a Japanese bullet train. Besides, any request for advance from employers for any emergency can be rudely refused. In Nepal one must stay self-sufficient all the time and saving is the only way to do so.

— Manohar Shrestha, Kathmandu

Saving money is one of the best things to be secured. Nothing is sure in our life. If we have money with us today then tomorrow the situation can be different. So saving money is one of the smartest things to do.

I usually do savings. I don’t have any tricks but I think sometimes we suffer from lack of money. Once when I was in a school, I was not able to attend picnic due to lack of money. The pocket money my parents used to give me had finished and I was afraid to ask more money to my parents thinking they would scold me. So I missed picnic with my friends. From that day I realised that money is very powerful and so I have to start saving it. And today whenever I don’t feel like saving, I recall that incident and automatically my mind starts to see so many future incidents like that.

My mum says those people who have the habit of saving the money is the luckiest person because money is the resemblance of Goddess Laxmi. By saving money we have to respect her. This is also the reason I do the saving. We never know what our life will be in future. May be in future we will face financial problem and so to make our future secure we have to do savings.

— Sonika Lamichhane

QUESTION OF THE WEEK

It is common to see pedestrians ignoring traffic rules in the Valley with only the motorists being penalised for violating the rules. But to ensure pedestrian safety, traffic cops are set to fine jaywalkers Rs 200 each from mid-May. Those without money to pay the amount will be briefly detained and freed after they attend a road safety classroom. Do you think this is the ideal solution to handle the nation’s jaywalkers? Why?

Send your replies in not more than 200 words by Friday, May 5, 2:00 pm to Features, The Himalayan Times, e-mail: features@thehimalayantimes.com